Palantir Technologies: Can the Stock Live Up to Lofty Expectations?

Palantir Technologies (NYSE: PLTR) has emerged as a leader in the realm of artificial intelligence (AI) stocks, captivating investors with its groundbreaking AI software applications. The company’s prowess in integrating AI with decision-making processes is unparalleled, making it a promising investment opportunity.

Despite the excitement surrounding Palantir, there are concerns about the inflated expectations driving up the stock price. As an investor, it’s crucial to evaluate whether Palantir can deliver on these high expectations or if a rude awakening is on the horizon.

Palantir’s Software Adoption and Revenue Growth

Palantir’s journey began in 2003, providing software solutions primarily to government agencies before expanding into the commercial sector. Its software streamlines data flows and empowers decision-makers with critical information, making it invaluable in high-stakes scenarios.

The latest addition to Palantir’s suite of products, the Artificial Intelligence Platform (AIP), offers developers the tools to integrate AI seamlessly across various business functions. This innovative approach to AI integration has resonated well with U.S. commercial clients, leading to a 55% increase in revenue to $159 million in the second quarter.

Moreover, Palantir’s second-quarter revenue surged by 27% year-over-year to $678 million, underscoring the company’s growth trajectory and profitability. Despite its success, Palantir’s high-priced software packages may limit its potential clientele, hindering widespread adoption.

Challenges in Valuation and Stock Performance

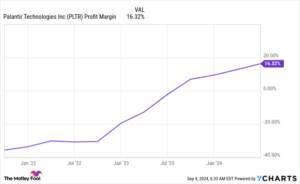

While Palantir continues to demonstrate strong financial metrics and profitability, its stock valuation remains a subject of scrutiny. With a forward price-to-earnings ratio of 86, the stock appears overvalued compared to industry benchmarks. To justify its valuation, Palantir must achieve profit margins akin to established software companies like Adobe, which boasts an average margin of 30%.

Projections suggest that Palantir needs to surpass Wall Street growth expectations and deliver industry-leading profit margins for an extended period to justify its current valuation. This highlights the elevated expectations embedded in Palantir’s stock price, indicating potential downside risks for investors.

Investment Considerations and Alternatives

Before investing in Palantir Technologies, investors should carefully assess the company’s growth prospects, valuation metrics, and market dynamics. While Palantir shows promise in the AI space, the stock’s current valuation and future performance pose challenges for investors seeking sustainable returns.

At Extreme Investor Network, we advocate for a comprehensive evaluation of investment opportunities, considering factors such as growth potential, competitive landscape, and valuation metrics. While Palantir Technologies presents an intriguing proposition, investors should explore a diversified portfolio and consider alternative investment options to mitigate risks and maximize returns. Visit our website for expert insights, market analysis, and investment recommendations tailored to your financial goals.

In conclusion, Palantir Technologies’ stock may face hurdles in meeting lofty expectations, underscoring the importance of prudent investment decisions and diversified portfolios in today’s dynamic market environment. Stay informed, stay empowered, and stay ahead with Extreme Investor Network.