When considering investment opportunities in the tech sector, it’s easy to default to the familiar names like Apple (NASDAQ: AAPL), the world’s largest company by market cap. However, a closer look under the hood reveals some potential problems that investors should be aware of before committing their capital.

At Extreme Investor Network, we believe there are better buys in the market right now that offer significant long-term upside compared to Apple. Companies like Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG, GOOGL), and Meta Platforms (NASDAQ: META) are poised to outperform Apple and deliver superior returns to investors.

### What’s Happening with Apple?

Despite its impressive market cap, Apple is facing challenges with sluggish revenue growth. Sales of iPhones have not seen significant increases since the onset of the pandemic, and the latest reports on the iPhone 16 sales are below expectations. This lackluster performance could spell trouble for the stock.

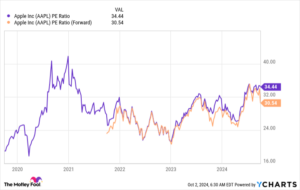

Trading at 34 times trailing earnings and 31 times forward earnings, Apple commands a premium valuation that may not be justified by its modest growth figures. In its most recent quarter, Apple saw sales grow by only 4.9% and earnings per share (EPS) by 10.2%, numbers that do not support its lofty valuation.

Looking ahead to fiscal 2025, Wall Street expects Apple to achieve 8% higher revenue and 17% EPS growth. While the immediate future may offer a slight improvement, the stock’s current price may not be justified by its growth prospects when compared to alternative investment options.

### Alternative Investment Opportunities

Instead of Apple, investors should consider companies like Nvidia, Alphabet, and Meta Platforms for their investment portfolios. These companies are outperforming Apple in terms of both revenue and EPS growth and offer attractive prospects for long-term growth.

Nvidia, known for its powerful graphics processing units (GPUs) driving artificial intelligence (AI), continues to experience strong demand in the market. Alphabet, the parent company of Google, dominates the search engine market and leverages its position to capitalize on lucrative advertising opportunities online. Meta Platforms, the parent of social media giants like Facebook and Instagram, generates significant revenue from ads on its platforms.

Despite their superior growth metrics, Meta and Alphabet do not command the same premium valuation as Apple. Nvidia, while slightly more expensive than Apple, offers lucrative prospects with its consistent revenue growth and strong performance in the AI sector.

At Extreme Investor Network, we prioritize investing in companies with sustainable business models, robust growth, and attractive valuations. Compared to Apple, Meta Platforms and Alphabet offer compelling opportunities for investors looking to diversify their portfolios with high-growth tech stocks.

### Conclusion

While Apple remains a strong company, its growth trajectory may not justify its current valuation, prompting investors to explore other investment opportunities. Companies like Nvidia, Alphabet, and Meta Platforms present compelling alternatives with superior growth prospects and attractive valuations.

As savvy investors, it’s important to consider all available options and make informed decisions that align with our investment goals. For more insights and recommendations on top-performing tech stocks, stay tuned to Extreme Investor Network for expert analysis and investment tips.

Don’t settle for mediocrity when you can aim for excellence in your investment strategy with our exclusive insights and recommendations. Join the Extreme Investor Network today and unlock a world of opportunities for maximizing your investment returns in the dynamic tech sector.