Stock splits have been making a major comeback in recent years. With the current bull market driving stock prices to all-time highs, companies like Amazon, Nvidia, and Chipotle are increasingly opting for stock splits to make their shares more accessible to investors and employees. But does a stock split really drive value for investors? Let’s take a closer look at a potential stock split candidate, Costco (NASDAQ: COST), and examine whether it’s worth considering buying ahead of a possible split announcement.

Costco has been on a remarkable growth trajectory, with its stock price soaring over 650% in the last five years to reach over $900 per share. The company’s market cap now stands at a whopping $400 billion, making it one of the leading companies in the United States. Costco has also delivered exceptional returns to long-term investors, with a total return of 150,000% since going public over 40 years ago.

Given its sky-high share price, Costco has previously implemented two stock splits in 1993 and 2000. With its stock price inching closer to the $1,000 mark, investors are anticipating another split in the near future. Companies typically opt for a stock split when their share prices exceed $1,000 to make them more affordable to a broader range of investors and to facilitate stock gifting to employees.

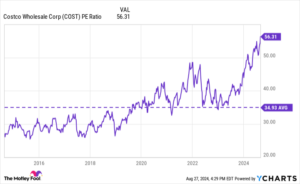

While Costco’s solid financial performance and international growth prospects are encouraging, the stock is currently trading at a premium valuation. With a price-to-earnings ratio (P/E) of 56, significantly higher than its historical average of 35, investors may be cautious about entering the stock at its current price levels.

It’s essential to note that a stock split does not impact the underlying fundamentals of a company. Fractional trading options now allow investors to purchase fractional shares, rendering stock splits less significant in terms of affordability and accessibility. Instead of focusing solely on the potential for a split, investors should evaluate Costco based on its business performance and valuation metrics to make informed investment decisions.

Ultimately, while Costco remains a strong business, its current valuation may deter some investors from entering the stock at its elevated price levels. As always, thorough research and analysis are crucial before making any investment decisions to align with your financial goals and risk tolerance.

Interested in gaining insight into market-leading stocks in today’s dynamic investing landscape? The Motley Fool Stock Advisor analyst team has identified the top ten stocks they believe hold tremendous potential for investors. Check out their recommendations and gain valuable information on building a successful portfolio with regular updates and new stock picks every month. Don’t miss out on the opportunity to leverage expert advice and analysis to maximize your investment returns.