The recent market volatility following Donald Trump’s election raises questions about the future of his proposed tariff policies. As the initial hype from the “Trump Trades” begins to fade, investors are starting to analyze whether his promises will come to fruition.

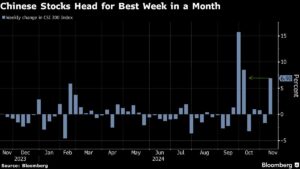

At Extreme Investor Network, we understand the importance of making informed investment decisions in times of uncertainty. While some assets, such as Chinese stocks and the yuan, have rebounded after being hit by tariff concerns, others like the dollar and Treasury yields have returned to pre-election levels.

Our experts point out that it’s crucial to consider factors beyond Trump’s policies, such as the Federal Reserve’s monetary policy and China’s fiscal stimulus, when evaluating investment opportunities. Vishnu Varathan from Mizuho Bank Ltd. notes that investors are reevaluating their positions and questioning whether their bets on Trump’s policies have been overdone.

One key issue on investors’ minds is the likelihood of Trump imposing the threatened tariffs, particularly on Chinese goods. As doubts linger, some investors are taking profits on trades that had initially performed well on expectations of inflation and higher interest rates under Trump.

Despite the current uncertainty, RBC Capital Markets remains optimistic that trades benefiting from a Trump presidency could regain momentum, especially if Republicans maintain control of the US House. A potential sweep would pave the way for Trump’s tax cuts and other policies.

When it comes to equities, the outlook varies for different regions. US stocks, especially small-cap companies and regional banks, have surged to record highs on the expectation of supportive policies under Trump. However, the situation in Asia, particularly China, is less clear as investors assess the extent of fiscal stimulus to counter higher tariffs.

Our analysts at Extreme Investor Network emphasize the importance of staying informed and proactive in navigating market shifts. By considering a variety of factors beyond Trump’s policies, investors can make strategic decisions to ensure their portfolios remain resilient in the face of uncertainty. Subscribe to our newsletter to receive the latest insights and analysis on finance and investing.