Navigating the Upcoming Triple-Witching: What Investors Should Know

As U.S. stocks show resilience after last week’s downturn, investors are gearing up for an important event this Friday—the quarterly options expiration, commonly referred to as “triple-witching.” This phenomenon is known to create a swath of volatility in the markets, making it essential for traders and investors to stay informed and prepared.

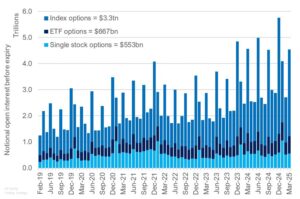

What exactly is triple-witching? In simple terms, it occurs when three types of derivative contracts—stock options, index options, and futures—expire simultaneously. According to estimates from Citigroup Inc., this quarter’s event will see approximately $4.5 trillion worth of contracts mature, an eye-watering number that underscores the potential for increased market activity and price volatility.

The Nature of the Beast

Though many of these contracts are expected to expire without value, some market analysts are skeptical about whether the event will lead to substantial market moves. Historically, however, triple-witching has been known to trigger sudden price swings as traders adjust their positions. This is particularly true as expiration day approaches and traders begin rolling over existing contracts.

Gareth Ryan from IUR Capital notes that the day before a significant contract expiration can be just as, if not more, active than the expiration session itself. "While there could be considerable trading volume on options expiration day, significant activity often occurs on the preceding day as traders engage in roll-outs, roll-downs, and the closing of positions," Ryan observes. Such preparatory moves are commonly seen with short options that may not need to be held until the actual expiration day.

Look Back to Learn

Reflecting on the last triple-witching event on December 20, the markets were extremely jittery, with the Cboe VIX Index spiking above 28 due to hawkish statements from the Federal Reserve. The subsequent fallout saw major indices, like the S&P 500, suffer significant declines. In contrast, as of the latest reports, the mood seems more optimistic. The S&P 500 enjoyed a robust 1.1% increase after Fed Chairman Jerome Powell stated there is no compelling reason to adjust current monetary policies, alleviating some fears surrounding recession and inflation.

Nonetheless, traders should remember that the quarterly options expiration can lead to drastic changes. As they unwind their positions, particularly in VIX futures, the resulting trading volume can either yield calmer waters or provoke wider market sways—it’s a risky game that some believe can quickly turn chaotic.

A Balanced Perspective

Citi’s equity trading strategist Vishal Vivek suggests that this week’s triple-witching may be “less significant” compared to previous expirations, noting the lower open interest and neutral positioning of dealers. This sentiment is echoed by Kevin Darby, vice president at CQG, who points out that dealers have likely been preparing for this moment and are well-equipped to navigate it. "They simply hedge their positions while allowing others to engage in the more speculative aspects of trading," Darby explains.

Conclusion

As Friday approaches, it’s crucial for investors to be aware of the dynamics at play during triple-witching. With a mix of optimism and caution prevailing in the markets, what happens next is anyone’s guess. Staying informed and strategically responding will empower investors to possibly leverage these fluctuations to their advantage.

At Extreme Investor Network, we encourage our community to remain vigilant, adapt their strategies, and seize opportunities in the ever-changing financial landscape. Whether your approach is conservative or more aggressive, staying informed is your best investment.