With the US presidential election just around the corner, traders around the world are bracing for potential impacts on global trade and emerging markets. From Mexico City to Shanghai, investors are analyzing the potential outcomes of a victory by either Donald Trump or Vice President Kamala Harris.

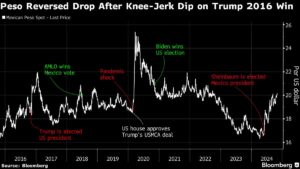

The uncertainty surrounding the election has led to increased volatility in markets, with hedge funds taking positions against the Mexican peso and the Chinese yuan slipping as the dollar strengthens. Emerging market stocks have experienced their worst monthly loss since January as investors anticipate the election results.

The implications of the election results on emerging markets are significant. A victory by Trump could lead to tariffs and disruptions in trade, affecting exports and currencies in these regions. On the other hand, a win by Harris is seen as a bullish move for emerging markets.

In the US, Trump’s policies could have a more pronounced impact on emerging markets compared to Harris, especially in terms of tariffs and trade relations. Additionally, Trump’s approach to international alliances could impact markets in Eastern Europe and Ukraine.

The outcome of the election may not be immediately clear, and the power of the incoming president will depend on various factors, including control of Congress. Export-driven emerging markets and countries with high external debts are closely watching the election results for potential impacts on their economies.

The Mexican peso and Asian currencies like the Chinese yuan are expected to react to the election outcome, with analysts predicting different scenarios depending on the winner. Bonds in El Salvador and Ukraine have seen movement ahead of the election, reflecting expectations of potential policy changes.

Equities in countries with high exposure to the US and China, like South Korea and Taiwan, could be affected by escalating trade tensions under a Trump administration. Latin American markets, such as Brazil and Mexico, are anticipating market reactions based on the election results, with potential relief rallies or weaknesses depending on the outcome.

Traders are closely monitoring interest rate decisions and economic data releases in various countries in anticipation of the election results. The implications of the US election on global markets are far-reaching, and investors are preparing for potential shifts in the financial landscape based on the outcome. Stay informed and connected with Extreme Investor Network for the latest updates and insights on the impact of the US presidential election on the finance world.