At Extreme Investor Network, we pride ourselves on providing unique and valuable insights into the world of finance. Today, we are diving into the recent movements in Chinese stocks after traders returned from a long weekend filled with negative developments that weighed heavily on sentiment.

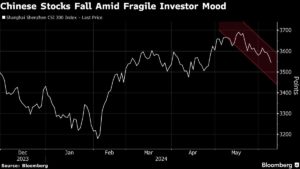

The CSI 300 Index of mainland shares closed down 0.9% to its lowest level in over six weeks, signaling a worrisome trend as markets reopened from the Dragon Boat Festival holiday. In Hong Kong, a gauge of Chinese shares listed on the stock exchange also saw significant declines, dropping as much as 2% before bouncing back slightly.

One of the factors contributing to the market downturn was weak travel spending, coupled with renewed concerns over the property sector, casting doubt on the sustainability of China’s economic recovery. Additionally, geopolitical risks surrounding electric vehicle makers added to the uncertainty as traders awaited the European Commission’s decision on provisional duties expected later in the week.

Our expert analysis reveals that recent events such as the lackluster consumption during the holiday weekend and weak property sales are contributing to the market’s pessimism. With macroeconomic readings like the NBS PMI and imports showing signs of weakness, investor confidence is understandably shaken.

Citigroup Inc. highlighted that while domestic tourism spending did increase slightly during the extended weekend, the momentum was weaker compared to previous short holidays. Analysts noted that average spending per traveler remained subdued, impacting stocks in the travel sector such as Changbai Mountain Tourism Co.

Despite authorities’ efforts to stabilize the property market, sentiments remain low as Dexin China Holdings Co. became the latest casualty in the industry. Developer stocks are also facing challenges, entering a technical bear market amidst doubts about the central government’s support package.

Looking forward, traders are anticipating more decisive measures to support the market, especially after recent efforts fell short of expectations. All eyes are now on the upcoming third plenum in July, a closed-door meeting that could potentially signal policy shifts and future actions to steady the slowing economy.

At Extreme Investor Network, we offer in-depth analysis and expert insights to help you navigate the complex world of finance. Stay informed and empowered with our unique perspectives on the latest market trends and developments.