Intel (NASDAQ: INTC) has been a major topic of conversation in the finance world this year, as the stock has plummeted by more than half its value year-to-date. The company’s management is reportedly considering significant changes to combat this decline, with news that Intel has hired bankers to explore options to jumpstart growth causing the stock to rise by 8%.

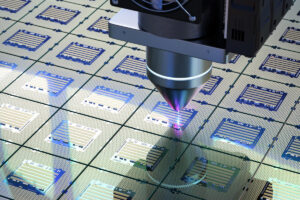

With rumors swirling about a potential breakup, investors are eagerly waiting to see what steps Intel will take next. The semiconductor giant has struggled in recent years, losing ground to competitors like Nvidia. In an effort to turn things around, Intel has brought on advisors from Morgan Stanley and Goldman Sachs to assess various scenarios, including splitting its product design and manufacturing businesses and shelving certain factory projects.

While these discussions are still in the early stages and no immediate actions are expected, Intel’s management is scheduled to present their findings to the board during a meeting in September. However, investors should not expect any quick fixes, as the focus is likely to be on conserving cash rather than immediately pursuing divestitures or breakups.

The uncertainty surrounding Intel’s future has left many wondering if now is the right time to invest in the company. While it’s clear that changes need to be made, it’s essential for investors to exercise caution before diving in. The Motley Fool Stock Advisor team, known for identifying high-performing stocks, has not included Intel in their list of top picks. Instead, they have identified 10 other stocks with massive potential for growth in the coming years.

This strategic insight from industry experts highlights the importance of thorough research and analysis before making investment decisions. By staying informed and following expert recommendations, investors can position themselves for success in today’s ever-changing market. Don’t miss out on the next big opportunity – visit Extreme Investor Network to access exclusive insights and recommendations to help you maximize your investment potential.