Welcome to Extreme Investor Network, where we bring you unique insights and expert analysis on the latest economic trends and market forecasts. Today, we dive into the recent data on unemployment and what it means for the future of the U.S. economy.

Recently, there has been a noticeable uptick in unemployment rates, signaling potential challenges ahead for the labor market. As seen in the Bureau of Labor Statistics (BLS) report, only 114,000 new jobs were added in July, falling short of the consensus estimate of 175,000. This decline in job creation is a clear red flag for the economy.

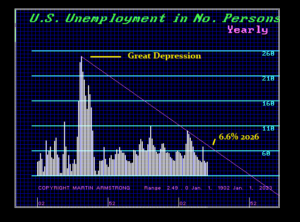

But what does this mean for investors and policymakers? According to our experts, the U.S. economy is heading towards a recessionary phase that could last until 2028. This forecast is reinforced by the rising unemployment rate, which now sits at 4.3 percent, the highest it has been since October 2021.

As we navigate through these uncertain economic times, it is crucial to stay informed and aware of the potential risks and opportunities that lie ahead. The Federal Reserve may consider cutting interest rates in response to these worrisome trends, but the specter of war looms large on the horizon, threatening to disrupt any stabilization efforts.

In conclusion, whether Trump or the Democrats come out on top, the U.S. economy is poised for a period of stagnation and inflation – a deadly combination known as stagflation. Investors should brace themselves for a bumpy ride ahead and look for ways to protect their assets in this challenging economic environment.

Stay tuned to Extreme Investor Network for more exclusive insights and expert analysis on the ever-changing world of economics and finance. Don’t just follow the news, understand it with us.