Hugo Boss Shares Plunge After Profit Guidance Cut: What Investors Need to Know

Hugo Boss, a German high-end fashion brand, recently shocked investors by slashing its profit guidance for the year. This news sent its shares tumbling to their lowest level since 2021. The company cited weakness in key markets, such as China and the UK, as the primary reasons behind the downward revision.

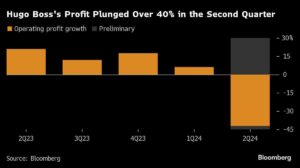

According to a statement released by the company, Hugo Boss now expects operating profit to range from €350 million to €430 million in 2024, down from the earlier forecast of €430 million to €475 million. This news also came with lowered sales expectations, adding pressure on the stock price.

The shares of Hugo Boss plummeted as much as 11% on Tuesday, hitting their lowest intraday level since April 2021. As of 11:14 a.m. Frankfurt time, the stock was down 8.7% at €36.88 and has declined by 45% year-to-date.

This significant setback comes as a blow to Chief Executive Officer Daniel Grieder, who has been leading the brand’s revamp efforts. Since joining the company in June 2021, Grieder has been working on revamping the clothing range to attract a younger demographic. However, the pandemic-induced shift towards casual wear and remote work have posed challenges for the brand.

Analysts are closely watching how Hugo Boss will navigate through this difficult period. Thomas Chauvet, an analyst at Citigroup Inc., noted that this is the first time the company has cut its full-year guidance during Grieder’s tenure. Chauvet also highlighted concerns about Hugo Boss’s ability to meet its 2025 sales and margin targets.

The luxury sector as a whole has been experiencing mixed results during the latest earnings season. While Burberry Group Plc’s shares took a hit after suspending its dividend and issuing a warning, other companies like Swatch Group AG and Richemont have seen fluctuations in their stock prices.

As investors monitor Hugo Boss’s next steps, the critical question remains whether the guidance revision is enough to de-risk 2024 and rebuild investors’ confidence in the company’s prospects. Experts like Jefferies analyst Frederick Wild are closely watching how the brand’s narrative will evolve in the coming months.

For more insights and analysis on the latest trends in the finance world, stay tuned to Extreme Investor Network. Our experts provide unique perspectives and valuable information to help you make informed investment decisions. Subscribe to our newsletter to receive exclusive updates and analysis straight to your inbox.