The Gold Withdrawal: Historical Reflections and Implications Today

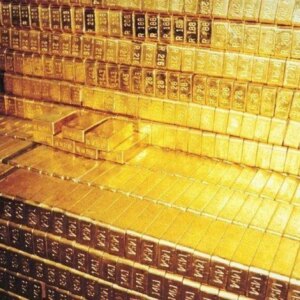

Image Source: Armstrong Economics

Welcome to Extreme Investor Network, where we delve deep into the nuanced world of economics and investment strategies. Today, we explore a topic that has both historical significance and contemporary relevance: the potential withdrawal of gold reserves by Germany from the United States. This complex issue draws parallels to historical events, particularly in the 1960s, and raises questions about global monetary systems, politics, and economic security.

A Historical Echo: France in the 1960s

In the 1960s, France took a bold stance against U.S. dominance in the global monetary framework, a move that ultimately reshaped its financial policies. Under President Charles de Gaulle, France initiated a series of gold withdrawals from the U.S., reclaiming its gold reserves during a period marked by political tensions and economic shifts. This historic episode serves as a critical lesson in the dynamics of international finance—one that resonates in today’s geopolitical landscape.

De Gaulle’s challenge to the status quo wasn’t just a knee-jerk reaction; it reflected deeper concerns about national sovereignty and economic independence. During this time, France executed Operation Vide-Gousset, repatriating 3,313 tons of gold—a logistical feat requiring over 44 boat trips and 129 flights. This gold retrieval was catalyzed by France’s desire to convert dollar holdings into the more stable asset of gold, which had been showing significant volatility due to the Bretton Woods framework.

The Empty Chair Crisis and Its Implications

The backdrop to this gold rush included the Empty Chair Crisis of 1965—a significant political standoff in the European Economic Community. De Gaulle’s concern over national influence vs. a growing federalized Europe led him to withdraw French ministers from decision-making councils, underscoring how political tensions often drive economic policies.

This crisis triggered a reevaluation of how European nations understood their autonomy in relation to centralized entities like the EU, mirroring today’s concerns among countries regarding their financial affiliations with the U.S.—especially in light of shifting geopolitical alliances and sentiments against perceived overreach by American policies.

Contemporary Concerns: Germany’s Perspective

Fast forward to today, the discussion surrounding Germany’s potential withdrawal of its gold reserves from the U.S. brings back memories of France’s actions decades ago. The new German government appears increasingly critical of U.S. foreign policy, seeing their gold holdings as a symbol of dependence. While history often repeats itself, the motivations and contexts change.

The contemporary landscape sees nations reacting against what they perceive as the over-privileged status of the U.S. dollar. De Gaulle once described the dollar as “monumentally over-privileged,” a sentiment that resonates in some circles today. As Germany considers repatriating gold as a safeguard against economic instability or political friction with Washington, we may witness a shift not just in asset allocation but in international relations.

Economic Signals and a Shifting Tide

The current environment evokes memories of other nations diversifying their reserves amid tensions. From the Netherlands to Belgium, countries are beginning to reconsider their dependencies on U.S. assets. The implications for the U.S. economy could be severe, considering that the value of gold has historically surged amid such withdrawals.

As we reflect on these issues, it’s clear that fears surrounding political uncertainty often drive nations to safeguard their assets. The ramifications extend beyond mere economic metrics—they speak to the heart of national identity and perception in a world where geopolitical partnerships are continually tested.

Conclusion: Lessons from History

At Extreme Investor Network, we recognize the value of understanding history when navigating today’s complex economic terrain. As we witness nations, including Germany, reconsidering their gold holdings, we are reminded of the single most important lesson from history: money flows where it feels safe. The movement of gold is not merely a reflection of market conditions but a powerful indicator of diplomatic relations and national priorities.

Stay tuned for more insights on the global economy, where we’ll continue to analyze how historical events shape contemporary financial strategies. Armed with this knowledge, investors can better prepare for the evolving economic landscape, ensuring their strategies are not just reactive but also proactive in securing their financial future.