Investing in the stock market can be a lucrative way to grow your wealth, especially if you follow in the footsteps of legendary investor Warren Buffett. Buffett made his fortune by buying shares of companies when they were undervalued, and right now, there are some great opportunities in the market to do just that. If you have some extra cash that you don’t need for immediate expenses, investing it in the right stocks could lead to significant returns over the next few years.

At Extreme Investor Network, we’re always on the lookout for undervalued stocks with the potential for high growth. Here are two stocks that we believe could soar in the coming years:

- Carnival (NYSE: CCL)

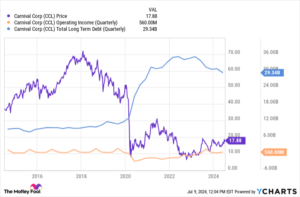

The travel industry is rebounding, and leading cruise line Carnival is well-positioned to benefit from this trend. Despite seeing its revenue and operating profit return to pre-pandemic levels, Carnival’s stock is still trading at a significant discount, down 76% from its previous peak. This presents a great buying opportunity for investors.

One of the factors weighing on Carnival’s stock price is the increase in the company’s debt during the pandemic. However, as Carnival’s revenue and operating profit continue to grow, the debt is expected to decrease, which should drive the stock price higher. With operating income jumping to $560 million in the second quarter, management is optimistic about the company’s future prospects.

Carnival is also set to launch Celebration Key, an exclusive destination for its passengers, which is expected to drive further revenue growth. Trading at a modest forward price-to-earnings ratio of 15, Carnival stock has the potential to climb higher as the company pays down debt and delivers profitable growth over the next few years.

- Roku (NASDAQ: ROKU)

Roku is a popular streaming platform with a growing user base of 81 million households. Despite delivering record revenue and free cash flows, Roku’s stock is down 87% from its previous highs, presenting an attractive buying opportunity for investors. The company’s user base continues to grow, attracting more advertisers to the platform and driving revenue growth.

With Roku’s trailing revenue nearly doubling and free cash flow tripling over the last three years, the stock is trading at an attractive price-to-free-cash-flow multiple of 20. However, uncertainty in the advertising market has kept the stock price subdued. Management expects accelerating platform revenue in 2025, making now a good time to consider investing in Roku before the stock potentially sees a significant uptick.

At Extreme Investor Network, our goal is to help investors identify undervalued stocks with high growth potential. With our expert analysis and insights, we aim to provide our members with unique opportunities to build wealth through strategic investments in the stock market. Stay tuned for more exclusive content and investment recommendations on our platform.