Navigating Market Uncertainty: Insights from the Extreme Investor Network

As the financial landscape shifts, staying ahead of market trends has never been more crucial. Recent revelations from Federal Reserve minutes have spotlighted a growing divide among policymakers concerning potential interest rate cuts. This internal conflict is contributing to a wave of unpredictability, leaving investors scrambling for solid ground.

According to the CME Group’s FedWatch Tool, there’s a 63% probability that the Fed will implement a 0.25% rate cut during December’s meeting. However, this not-quite-sure-footing leaves many investors poised on the edge of their seats, eagerly awaiting the release of key U.S. inflation data and Q3 GDP figures that could offer much-needed direction.

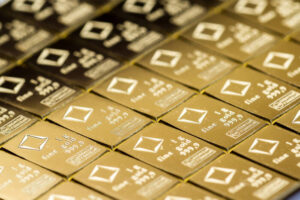

Geopolitical Dynamics Elevate Gold Demand

While monetary policy uncertainty looms large, gold is shining brighter than ever due to escalating geopolitical concerns. Tensions surrounding the Russia-Ukraine conflict are intensifying, marked by drone strikes and advanced missile deployments. As uncertainty grows, gold is increasingly seen as a safe haven—a protective asset against rising global risks.

Moreover, the recent proposal from U.S. President-elect Donald Trump to impose tariffs on imports from Canada, Mexico, and China has added yet another layer of complexity to international markets. This impending upheaval has led to a notable shift in investor behavior, with many flocking toward gold to insulate their portfolios from potential market fallout.

Outlook: Key Drivers for Gold Prices

At Extreme Investor Network, we believe understanding the catalysts behind market movements is essential for any serious investor. Currently, gold prices find themselves underpinned by a trifecta of factors: weakness in the dollar, persistent uncertainty around Federal Reserve policy, and looming geopolitical risks. However, the resistance level around $2,645 indicates that gold’s ascent may face obstacles unless a substantial market catalyst emerges.

Looking ahead, traders and investors alike are closely monitoring not only economic indicators like the Personal Consumption Expenditure (PCE) Price Index but also preliminary Q3 GDP data. These metrics will be instrumental in shaping the Fed’s future policy decisions and, in turn, influencing the overall market trajectory.

Why Choose Extreme Investor Network?

In a world where financial information abounds, why should you turn to Extreme Investor Network? We don’t just report the news; we analyze it through the lens of experienced investors who understand the nuances of the market. Our commitment to delivering in-depth analyses and actionable insights sets us apart as your go-to resource for navigation through the complexities of stock trading and investment strategy.

Join us at Extreme Investor Network, and empower your investing journey with knowledge and foresight that keeps you one step ahead. Whether you’re a seasoned trader or just starting out, we provide the tools and insights necessary to make informed decisions in an unpredictable market environment.