The recent GameStop saga involving Keith Gill, also known as ‘Roaring Kitty’, has captured the attention of many investors and traders. Gill’s massive trading activity late Wednesday, particularly in GameStop $20 calls expiring June 21, has raised eyebrows and speculation in the financial world.

At Extreme Investor Network, we understand the importance of staying informed about market developments, especially when it involves high-profile figures like Keith Gill. His social media posts claiming to have purchased 120,000 contracts have added fuel to the fire, leading to significant movements in GameStop’s share price.

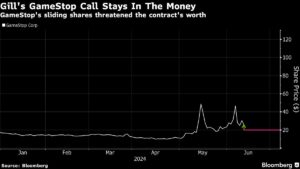

The implications of Gill’s position in GameStop are significant, as the company took advantage of the rally to sell $2.14 billion of shares. The looming question of whether Gill will exercise his contracts or close out his position has kept investors on edge, impacting the stock’s performance.

While Gill’s trading activity on Wednesday remains a mystery, the potential of him exiting his position could have a substantial impact on GameStop’s shares. The $20 calls, which traded as high as $13.90 earlier in the day, closed at $6.40, still above Gill’s reported average purchase price.

As experts in all things finance, Extreme Investor Network keeps our readers up-to-date on the latest market trends and developments. Stay tuned for more insights and analysis on key players like Keith Gill and their impact on the financial landscape.