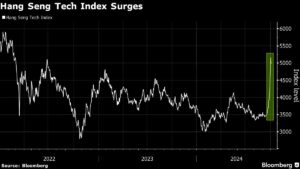

When it comes to Chinese tech stocks, the recent rally has caught the attention of many investors. The surge in prices has been attributed to fresh buying rather than short covering. This trend is especially prevalent among major companies like Alibaba Group Holding Ltd., JD.com Inc., and Baidu Inc.

The Chinese tech sector has faced challenges over the past few years, including a weakening economy, government crackdowns, and intense competition. However, recent announcements of stimulus measures by the Chinese government have sparked a buying spree, leading to significant gains in the sector.

Short sellers have not rushed to cover their bearish bets despite incurring mark-to-market losses. The short interest for companies like Alibaba, JD.com, and Baidu remains around 2% to 3% of available shares. If the rally continues, there could be a significant amount of short covering, which would further drive up stock prices.

Analysts have differing opinions on the recent rally. While some believe that consumers are still focused on downtrading trends in sectors like e-commerce and food delivery, others see bullish signals in the options market. Bets for gains on a US exchange-traded fund tracking China’s large-cap stocks are near their highest levels, with record call trading for companies like Alibaba and JD.com.

In the midst of this market activity, it’s crucial for investors to stay informed and make strategic decisions. At Extreme Investor Network, we provide expert analysis and insights to help you navigate the world of finance and make informed investment choices. Stay tuned for more updates on the latest trends and developments in the financial markets.