The recent surge in shares of long-moribund preferred stock issued by Fannie Mae and Freddie Mac has caught the attention of investors and financial analysts alike. Speculation is rife that Donald Trump’s potential return to the White House may lead to the release of these housing finance agencies from their crisis-era conservatorship, prompting a significant uptick in stock prices.

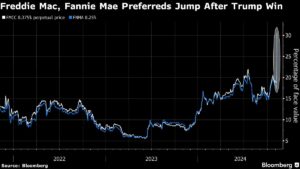

A $6 billion perpetual issue by Freddie Mac, sold back in 2007, saw a 70% surge, reaching its highest level in over three years. Similarly, Fannie Mae’s $7 billion series, also issued around the same time, skyrocketed by almost 68% from its pre-election close. This resurgence in preferred stock value indicates renewed hope among investors of getting a return on their investments after years of dormancy.

Ben Elliott, a Bloomberg Intelligence analyst, noted that the re-election of former President Donald Trump has reignited efforts to transition Fannie Mae and Freddie Mac out of government conservatorship. However, he cautioned that the process is expected to be lengthy, with potential release not before 2026-2027.

These housing finance giants, although not directly involved in mortgage lending, play a crucial role in the US housing market by buying home loans from lenders, securitizing them, and guaranteeing repayment to investors. The government’s intervention during the 2008 crisis resulted in a bailout of approximately $187.5 billion. The recent surge in stock prices reflects the ongoing debate surrounding the future of these agencies and the potential implications for investors.

At Extreme Investor Network, we understand the significance of staying informed about market trends and developments that can impact your investment decisions. Stay tuned to our platform for expert insights and analysis on the latest financial news and updates. Join our network of savvy investors today and take your financial knowledge to the next level.