Welcome to Extreme Investor Network, where we provide unique insights and analysis on the stock market, trading, and all things Wall Street. Today, we dive into the latest updates in the world of finance:

U.S. Business Activity and Employment Data:

Recent data indicates that U.S. business activity has reached a 26-month high, driven by a rebound in employment. With initial unemployment benefit claims also on the decline, the labor market appears robust. These positive economic indicators have led to speculation that the Federal Reserve might delay interest rate cuts, impacting gold prices in the process.

Federal Reserve Rate Cut Speculation:

Mixed signals from Federal Reserve officials have created uncertainty among investors. While some suggest a single rate cut by the end of the year, others emphasize the need for more data before making any policy changes. This ambiguity has contributed to fluctuations in gold prices, prompting traders to closely monitor economic data and Fed communications for insights.

Global Economic and Geopolitical Factors:

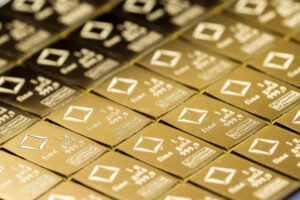

Geopolitical tensions in the Middle East, political uncertainties in Europe, and economic challenges in China have all played a role in supporting gold as a safe-haven asset. With upcoming elections in France and the UK, as well as concerns about China’s industrial output and government debt, investors are turning to gold amidst a risk-off sentiment.

Key Upcoming Events:

This week, keep an eye on major U.S. economic reports, including GDP (2nd revision), Initial Jobless Claims, and Core PCE. These reports, along with speeches from Fed officials, could have a significant impact on gold prices. Stay alert for signals about economic growth, inflation, and potential shifts in monetary policy.

Market Forecast:

Short-term outlook for gold appears bearish, driven by uncertainty surrounding the Federal Reserve’s rate cut timeline and China’s gold-buying trends. A stronger U.S. dollar and rising Treasury yields are also putting pressure on gold prices. Traders should exercise caution and stay informed about upcoming economic data, as positive indicators could delay rate cuts and further depress gold prices.

Stay tuned to Extreme Investor Network for more in-depth analysis and expert insights on the stock market and trading strategies. Make informed decisions and maximize your investment opportunities with our exclusive content.