Welcome to the Extreme Investor Network, where we provide expert insights and analysis on the Stock Market, trading, Wall Street, and more. Today, we will be diving into the latest updates on XAU/USD trading and how it is impacting market sentiment.

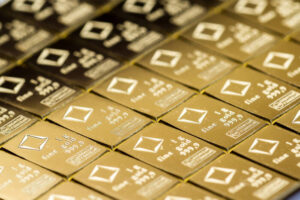

At 09:18 GMT, XAU/USD is trading at $2344.66, showing an increase of $10.66 or +0.46%. The market is closely watching the upcoming release of the core personal consumption expenditures price index (PCE) on Friday, as it is the U.S. Federal Reserve’s preferred inflation measure. The results of this index could have a significant impact on gold prices, as historically, gold has served as a hedge against inflation. However, the appeal of non-yielding gold tends to diminish when interest rates are higher, as it raises the opportunity cost of holding the metal.

Technical indicators suggest that gold might see a further decline into the range of $2,313.07 to $2,277.34, potentially triggering a technical bounce. However, if U.S. economic data continues to outperform expectations, the downward pressure on gold prices may persist. Recent market sentiment has turned bearish, with some investors liquidating positions influenced by the Federal Reserve’s stance on maintaining higher interest rates.

The Federal Reserve’s outlook on achieving its 2% inflation target has tempered market expectations for rate cuts, with traders now predicting only a 62% chance of a rate reduction by November 2024, according to the CME FedWatch Tool. Given these market conditions and the Federal Reserve’s stance, the short-term outlook for gold remains bearish. Traders should exercise caution, as the upcoming inflation data could lead to further volatility in the market.

Stay tuned to the Extreme Investor Network for more expert analysis and insights on the Stock Market, trading, and financial news. Join our community of savvy investors to stay ahead of the curve and make informed decisions in today’s fast-paced market environment.