As investors, we all know that staying informed about market conditions is crucial to making smart financial decisions. And one key indicator that investors closely monitor is inflation. Inflation can impact interest rates, consumer spending, and overall economic growth. That’s why many eyes are on the Federal Reserve’s favored inflation yardsticks, which are likely to show the tamest monthly advances since late last year.

According to economists surveyed by Bloomberg, the May personal consumption expenditures price index is expected to show no change, while the core measure (which excludes food and energy) is projected to see a minimal 0.1% gain. These numbers could pave the way for the Fed to consider lowering interest rates, possibly as soon as September.

It’s worth noting that while inflation remains subdued, the labor market is still relatively healthy. This could give the Fed some flexibility when it comes to timing interest rate cuts. Additionally, the latest inflation numbers will be accompanied by personal spending figures, which will shed light on services outlays and income trends.

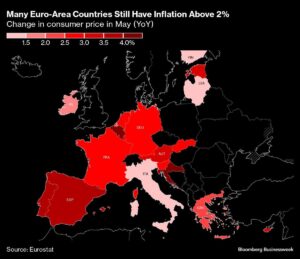

In Canada, central bank Governor Tiff Macklem is set to speak, while consumer price data and GDP figures for April will provide crucial insights. Meanwhile, in Europe, the Riksbank decision in Sweden is anticipated to pause their easing cycle after an initial rate cut last month.

As investors, it’s important to keep an eye on inflation trends, central bank decisions, and economic indicators across the globe. These factors can have a significant impact on investment strategies and financial markets. Stay informed and stay ahead of the curve with the latest updates from Extreme Investor Network. Be sure to check back for more expert analysis and insights on all things finance.