Are you confused about the roles of the Federal Reserve and Congress when it comes to the economy? It’s a common misconception that the Fed controls everything, especially with terms like Quantitative Easing (QE) being thrown around. But in reality, the Fed can only set short-term interest rates, while the Treasury is responsible for issuing debt.

At Extreme Investor Network, we aim to demystify complex economic concepts and provide our readers with valuable insights. For example, did you know that when there is a financial panic, people tend to run for cash, causing short-term assets to rise and long-term debt to decline? This can lead to an inverted yield curve, where short-term rates go above long-term rates.

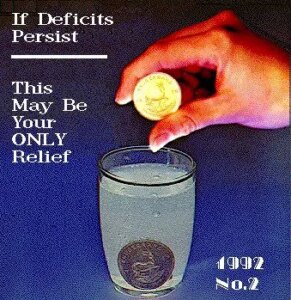

And what about the idea that the government can simply print money to avoid defaulting on its debt? While it’s true that the government can technically print money, doing so excessively can have disastrous consequences for the economy. At Extreme Investor Network, we provide in-depth analysis on why simply printing money is not a sustainable solution.

When it comes to forecasting political events like a potential Michelle Obama vs. Hillary Clinton showdown, it’s not as simple as plugging in data to a computer. Factors like personal life Exponential Cycles (ECMs) can play a significant role in shaping outcomes.

At Extreme Investor Network, we go beyond the surface-level information to provide our readers with unique perspectives and insights. Whether you’re a seasoned investor or a newbie to the world of economics, our content is designed to educate and empower you on your financial journey. Visit our website today to gain access to exclusive content and expert analysis that you won’t find anywhere else.