Extreme Investor Network presents: European Stocks and US Futures React to Geopolitical Tensions and Key Economic Data

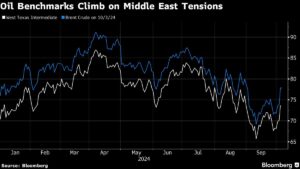

As the world awaits crucial American jobs data that will impact interest rates, European stocks and US futures have been experiencing fluctuations. This market uncertainty comes after the recent oil price rally eased following escalating tensions in the Middle East, resulting in the largest one-day jump in almost a year.

Investors are closely watching the Stoxx 600 index, which remains relatively unchanged and is on track for a weekly loss as optimism surrounding Chinese stimulus measures diminishes. Meanwhile, Treasuries have remained flat after a previous sell-off, and the dollar strength index is set for the largest weekly gain in nearly six months as expectations for aggressive US rate cuts are scaled back.

Amidst geopolitical uncertainty, market participants are eagerly anticipating signals about the strength of the US economy, particularly as the monthly payrolls report is scheduled for release on Friday. Projections suggest that the unemployment rate will remain steady at 4.2% in September, with an expected increase of 150,000 in payrolls.

Robert Tipp, chief investment strategist at PGIM Fixed Income, notes, “Anything that would point to a stabilizing or re-acceleration of growth will force markets to re-consider the current aggressive pricing of interest rate cuts.”

Following a surge in oil prices on Thursday, West Texas Intermediate and Brent crude have slightly decreased. These price hikes were triggered by President Joe Biden’s remarks regarding potential Israeli strikes against Iranian oil facilities.

In other economic indicators, positive signs have emerged from the US economy. The Institute for Supply Management’s services index outperformed expectations, and while applications for US unemployment benefits rose slightly, they remained at a level indicative of minimal layoffs. Continuing claims, which reflect the number of individuals receiving benefits, saw little change from the previous week.

Wei Liang Chang, a foreign-exchange and credit strategist at DBS Bank Ltd., highlighted, “The US dollar could stay supported on safe haven demand amid Middle East risks, and more so if US payrolls surprise on the upside.”

Key events to watch this week include developments in the following markets:

Stocks:

– Stoxx Europe 600: Up 0.2% as of 8:23 a.m. London time

– S&P 500 futures: Unchanged

– Nasdaq 100 futures: Up 0.2%

– Dow Jones Industrial Average futures: Unchanged

– MSCI Asia Pacific Index: Up 0.4%

– MSCI Emerging Markets Index: Up 0.5%

Currencies:

– Bloomberg Dollar Spot Index: Unchanged

– Euro: Unchanged at $1.1032

– Japanese Yen: Up 0.5% to 146.21 per dollar

– Offshore Yuan: Unchanged at 7.0566 per dollar

– British Pound: Up 0.2% to $1.3146

Cryptocurrencies:

– Bitcoin: Up 0.8% to $61,278.58

– Ether: Up 1.7% to $2,380.89

Bonds:

– Yield on 10-year Treasuries: Unchanged at 3.84%

– Germany’s 10-year yield: Increased three basis points to 2.17%

– Britain’s 10-year yield: Increased three basis points to 4.04%

Commodities:

– Brent Crude: Up 0.3% to $77.85 a barrel

– Spot Gold: Up 0.2% to $2,661.54 an ounce

Stay tuned for the latest updates in the financial world, brought to you by Extreme Investor Network. Additional insightful analysis and expert commentary are available on our platform to help you navigate through the ever-changing landscape of global markets. Make informed investment decisions with our exclusive resources and cutting-edge market insights. Subscribe now for exclusive access to premium content and stay ahead of the game in the world of finance. Extreme Investor Network – Where Extreme Investors Strive.