As the financial markets remain unpredictable, investors are closely watching key corporate earnings reports for guidance. European shares saw a modest increase, particularly in basic resources, following BHP Group Ltd.’s earnings report, which met expectations. The Stoxx Europe 600 rose by 0.3% at the start, with Anglo American Plc and Rio Tinto Plc also seeing positive gains.

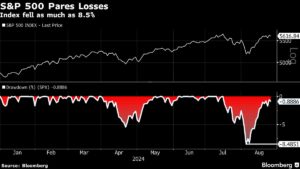

In the US, equity futures remained steady after a tech-driven decline on Monday. Meanwhile, Asian stocks experienced a slight dip, breaking a three-day winning streak. The focus remains on corporate earnings, with Nvidia Corp.’s financial results scheduled for release on Wednesday.

The slow economy and high valuations have led to a cautious approach among investors, with concerns about pricey tech stocks. However, there is optimism that a broader market rally could be on the horizon, should the tech sector stabilize.

Chinese consumption stocks faced scrutiny amid slow sales warnings, with PDD Holdings Inc. experiencing record declines. The Hang Seng Tech Index also saw a significant drop. US inflation data this week could further solidify expectations of upcoming rate cuts, while consumer spending figures will provide insight into the overall economic health.

Looking ahead, key events this week include US Conference Board consumer confidence data on Tuesday, Nvidia’s earnings report on Wednesday, and various economic indicators from Japan and the Eurozone on Friday.

Amidst market fluctuations, it’s crucial for investors to stay informed and make well-informed decisions. At Extreme Investor Network, our team of finance experts provides unique insights and analysis to help you navigate the ever-changing financial landscape. Stay tuned for more updates and valuable information to enhance your investment strategy.