El Salvador’s Dollar Bonds Surge: A Positive Outlook After Bitcoin Law Changes

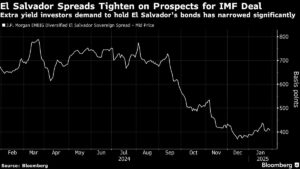

In a significant turn of events for the Central American nation of El Salvador, the value of its dollar bonds experienced a substantial uptick, leading the emerging markets on Thursday. This rally came in response to pivotal amendments in the nation’s Bitcoin legislation that have been deemed essential for securing a $1.4 billion loan from the International Monetary Fund (IMF).

Investor Confidence on the Rise

Reflecting investors’ optimism, government debt across the maturity curve saw gains, with bonds set to mature in 2054 climbing 2.7 cents to trade at 107 cents on the dollar. This surge signals a strong market sentiment surrounding El Salvador’s efforts to solidify its financial footing. According to Barclays strategist Jason Keene, "This was the law they needed to pass to get the multilateral funding. We expect to see IMF Board approval in the coming weeks."

Key Legislative Changes

The reforms approved by the Salvadoran Congress have made it optional for businesses to accept Bitcoin as payment, while also mandating that the government settle its domestic and foreign obligations in the currency in which they were issued. Such adjustments are critical for aligning with international financial standards while still maintaining the nation’s commitment to Bitcoin adoption.

Currently, El Salvador holds 6,049 Bitcoin in its reserves, valued at approximately $636 million, and continues to accumulate Bitcoin—even amidst a transformative legislative environment. Ambassador Milena Mayorga emphasized that the government remains dedicated to regular Bitcoin purchases and sustaining an ecosystem that supports the use of digital assets.

The Performance of Dollar Debt

Impressively, El Salvador’s dollar-denominated bonds have yielded a remarkable 30% return over the last year—more than tripling the average returns of a comparable index of emerging-market sovereign debt. This performance provides a glimpse into the increasingly complex interaction between traditional finance and cryptocurrency markets.

A Historical Perspective

In 2021, El Salvador made history by becoming the first country to adopt Bitcoin as legal tender alongside the US dollar, propelling President Nayib Bukele into the spotlight as a Bitcoin innovator. However, this bold move placed the country at odds with the IMF, which opposed Bitcoin’s inclusion as legal currency.

After extensive negotiations, President Bukele consented to changes in the law, aligning them with IMF requirements. This compromise has led to a rise in bond prices, with many now trading above par, indicating a healthy investor appetite.

What Lies Ahead

While the recent developments pave a smoother horizon for El Salvador’s economic landscape, portfolio manager Thys Louw from Ninety One UK Ltd warns that the anticipated IMF deal may already be fully priced into the bonds. Thus, future performance hinges on the country’s ability to implement further economic reforms.

Conclusion

For savvy investors eyeing emerging markets, El Salvador presents a compelling blend of risk and opportunity. The dynamics between cryptocurrency adoption and traditional finance are still unfolding, and those who stay informed on these intricate developments stand to gain the most. As we at the Extreme Investor Network continue to track these trends, there is much to watch as this unique legal and regulatory landscape evolves.

Stay tuned as we delve deeper into the implications of these changes and explore how they may affect your investment strategy.