Intel: Navigating a Tumultuous Landscape in Semiconductor Investing

Investors are all too familiar with the turbulence of the semiconductor industry, and one name that has recently become synonymous with struggle is Intel Corp (INTC). Once the undisputed leader in CPU technology, Intel has found itself overshadowed by formidable competitors like Nvidia (NVDA) and Advanced Micro Devices (AMD). The stark reality of this shift is highlighted by the market cap comparison; Nvidia’s stock now boasts a market capitalization that is approximately 40 times that of Intel’s.

Current Sentiment and Market Position

The mood among Intel investors has turned sour, particularly following the company’s recent struggles. After hitting a significant low, new leadership has emerged along with whispers of potential takeover interest. Although some may feel hopeful for a turnaround, others, including myself, believe caution is warranted. For now, I maintain a Hold rating on Intel, opting instead to earn income from a commitment to buy shares at a lower price.

Intel’s recent stock performance has been alarming. The company experienced a staggering 26% decline on August 1, 2024, marking its most significant single-day drop in over a decade. This drastic downturn was punctuated by days that also saw losses exceeding 5%. Following its Q2 2024 results, even contrarian investors shied away, questioning Intel’s entire business relevance as margins dwindled and layoffs loomed.

Given the severity of these challenges, it’s important to note the implications of Intel’s finances. The company announced a suspension of its dividends, which raised eyebrows, as its Free Cash Flow (FCF) has been negative since 2022. With nearly $30 billion in net debt and dwindling prospects, Intel’s current financial health appears precarious at best. The second quarter results have effectively served as a turning point, casting doubts on the viability of its existing strategic arc.

Exploring Potential Value

Despite the pain experienced by shareholders, Intel’s dividends were not heavily held by large funds this summer, illustrating a silver lining amid the gloom. Nonetheless, I still see latent value in Intel. The company owns tens of thousands of patents and has a long-standing reputation for producing reliable chips. While its investor reputation has taken a hit, relationships with long-time PC clients appear more stable. This sector could provide a foundation for Intel to rebuild as it grapples with technological changes, particularly in the age of AI.

In the graphics processing unit (GPU) realm, the new leadership team, led by co-CEOs Michelle Johnston Holthaus and David Zinsner, seems to be taking a pragmatic approach. Rather than confronting Nvidia and AMD head-on, the focus may shift to establishing a viable niche. One example is the Arc B580, which has garnered some favorable reviews.

Furthermore, Intel’s restructuring options could be vast—from splitting its Foundry and Products divisions to potentially selling assets, all while waiting for the right market conditions. One reassuring sign is Intel’s reluctance to rush into transactions with Qualcomm (QCOM) or other potential buyers. In times of weakness, it’s wise for companies to remain patient rather than hastily sell.

Leadership Dynamics and Future Prospects

However, the co-CEO arrangement raises some concerns. With critical decisions needing to be made, it’s possible that having two leaders could lead to indecision or stalemates. Over the past months, Intel’s shares dipped below $20, only to rally post better-than-expected Q3 results. But that uplift proved short-lived, with the stock sliding back to the $20 mark following the retirement of former CEO Pat Gelsinger.

I anticipate that INTC shares might see another dip due to potential tax-loss selling in the near future. As some actively managed funds clean up their portfolios ahead of 2025, Intel could face additional selling pressure.

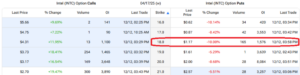

In light of these fluctuations, I’ve recently engaged in a strategy involving Put Options. I sold puts at $17.50 when shares initially plunged, allowing me to profit from premiums. Currently, I’ve re-entered this strategy by selling April 2025 $18 put options, trading at a premium of $1.17. If Intel’s stock falls below $18 and the options are exercised, I’ll have effectively secured a long position at $16.83—a level I find appealing.

Analyst Outlook

Looking at the broader analyst landscape, the consensus is largely neutral. With 29 analysts covering Intel, there’s a disproportionate number of Hold ratings (22) compared to just one Buy and six Sell ratings. The average price target sits at $24.43, offering over a 20% upside potential from current levels; however, the market seems hesitant.

Although I believe Intel has the potential to recover, I’m not yet ready to buy the common stock. The risk of the shares retesting their September lows looms large. Analysts anticipate a challenging 2024, with expected losses but a possible recovery in EPS to $0.98 in 2025. That equates to a forward P/E of about 21, which isn’t quite a bargain for a company navigating such uncertainty.

For now, I plan to maintain my strategy of selling April 2025 $18 put options, generating income along the way, while conservatively observing Intel’s trajectory. With many industry players adopting similar cautious stances, keeping a watchful eye on Intel will be crucial in the months to come.

Conclusion

While the semiconductor landscape is ever-evolving, Intel’s journey is a testament to resilience and the potential for recovery, even amidst substantial challenges. Investing in this sector, particularly with companies like Intel, requires a balanced approach that combines analysis, patience, and a readiness to adapt to market dynamics. The future may still hold promise for Intel, but the path to recovery is fraught with hurdles that investors must navigate carefully.