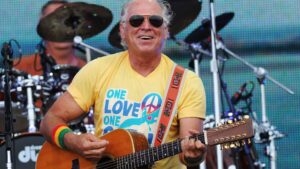

Navigating the Turbulent Waters of Estate Battles: Lessons from Jimmy Buffett’s Legacy

The recent court battle surrounding the $275 million estate of the beloved musician Jimmy Buffett has ignited discussions about wealth transfer and litigation, especially as a staggering $100 trillion is set to pass from one generation to the next in the coming years. At Extreme Investor Network, we believe it’s crucial for families and individuals to learn from high-profile cases like Buffett’s to ensure smoother transitions of wealth.

The Legal Saga Unfolds

In a Los Angeles court, Jimmy Buffett’s widow, Jane Buffett, initiated legal proceedings to remove Richard Mozenter, her co-trustee, from the marital trust established to secure her financial future after her husband’s passing in 2023. Jane characterized Mozenter’s actions as "openly hostile" and accused him of mismanaging trust assets and collecting exorbitant fees of $1.7 million annually. Such allegations spotlight the complex emotions and tensions that often accompany the management of estates.

Mozenter, in his defense, filed a lawsuit in Palm Beach County, claiming Jane’s obstructive behavior has strained their working relationship. This conflict is emblematic of a growing trend: as wealth transfers increase, so too do legal disputes over estates and trusts.

The Buffett Legacy: More Than Just Music

Buffett wasn’t just a musical icon; he was a savvy businessman who built a sprawling brand that included restaurants, hotels, and merchandise tied to his "Margaritaville" persona. The complexity of his estate—comprising real estate, vehicles, and trademark assets—demonstrates the need for meticulous planning when it comes to wealth management.

Despite these sophisticated structures, the current dispute highlights critical oversights in communication and expectations. Buffett’s will, revised multiple times over the last three decades, aimed to protect Jane’s interests. Yet the introduction of a co-trustee created unforeseen friction, outlining the vital role of transparency in estate planning.

The Lessons for Wealth Holders

1. Communicate Early and Often

One of the paramount lessons from this case is the importance of open communication surrounding estate plans. Wealth holders should openly discuss their wishes with all potential beneficiaries. Had Buffett clarified the roles and responsibilities associated with his trust, the sense of betrayal and hostility might have been mitigated.

2. Choose the Right Trustee

The selection of trustees is a delicate dance. While friends or associates may seem like good candidates, they can bring complicating interpersonal dynamics into the mix. Creating a family trust with professional fiduciaries can often yield better outcomes, ensuring that the trust is managed according to its original intent.

3. Provisions for Changing Circumstances

Estate plans should include provisions for adaptations over time. A “removal right” embedded in the trust could have empowered Jane to replace Mozenter more readily when conflicts arose.

4. Understand the True Nature of Assets

Not all assets will produce immediate returns. Real estate or collectibles often require maintenance and can consume financial resources without providing direct income. A well-structured estate plan takes these nuances into account, helping to set realistic expectations for beneficiaries.

Looking Forward: The Future of Estate Planning

As Jimmy Buffett’s case demonstrates, the complexities of wealth transfer are more pronounced than ever. The increase in wealth passing down to future generations will undoubtedly lead to further legal challenges. By examining these high-profile conflicts, we at Extreme Investor Network hope to equip our readers with insights into effective estate planning.

Conclusion

Navigating the complexities of wealth transfer and estate management requires foresight and careful consideration. By learning from notable cases like that of Jimmy Buffett, individuals can avoid the pitfalls of miscommunication and interpersonal conflict. Ensuring that your estate plan is transparent, well-structured, and adaptable is essential for safeguarding your legacy and the interests of those you leave behind.

Join us at Extreme Investor Network for more insightful discussions and resources to help you manage and grow your wealth for generations to come.