Nvidia (NVDA), a market leader in Artificial Intelligence (AI), experienced a notable decline in market capitalization following its Q2 earnings in late August. However, the stock has shown resilience, rising 5% in the last week. With a strong presence in the AI sector, Nvidia remains a top choice for investors looking to capitalize on the company’s growth potential.

NVDA’s Long-Term AI-Driven Growth Trajectory Remains Intact

Nvidia’s position as a leader in AI is solidified by its collaborations with top clients such as Microsoft, Alphabet, Meta, and Amazon. Despite already catering to major players, Nvidia’s AI solutions continue to expand across various industries, offering a promising outlook for the company. Enterprises worldwide are keen on integrating AI solutions into their operations, further enhancing the growth prospects for NVDA stock.

In addition to being a frontrunner in AI GPU processors, Nvidia offers a comprehensive AI infrastructure that boosts efficiency and productivity. This end-to-end solution sets Nvidia apart from its competitors, establishing the company as a one-stop AI powerhouse.

NVDA Remains a One-Stop AI Powerhouse with Margin Growth

Under the leadership of CEO Jensen Huang, Nvidia is focused on establishing itself as a dominant force in the AI-driven data center market. By providing a complete hardware and software ecosystem, Nvidia can command premium pricing for its products, leading to steady margin growth. Despite concerns about the sustainability of Nvidia’s impressive revenue and margin growth, the company’s future outlook remains positive.

Nvidia’s Impressive Quarterly Earnings

Nvidia’s recent Q2 earnings report showcased robust performance, with adjusted earnings exceeding analyst estimates. The company experienced significant year-over-year revenue growth, particularly in its Data Center division. While the stock faced a slight downturn following the earnings report, Nvidia’s long-term growth trajectory remains promising.

NVDA’s Insider Selling Concerns are Over

Recent insider selling at Nvidia raised some concerns among investors. However, CEO Jensen Huang’s sales were part of a predetermined trading plan and do not reflect a lack of confidence in the company. As the largest individual shareholder of Nvidia, Huang’s stake in the company demonstrates his commitment to its long-term success.

NVDA Valuation Isn’t Expensive, Given Its Earnings Growth Prowess

Despite concerns about Nvidia’s valuation, the stock remains reasonably priced compared to its peers. With strong growth potential and consistent outperformance, Nvidia presents an attractive investment opportunity for those looking to capitalize on the company’s AI leadership.

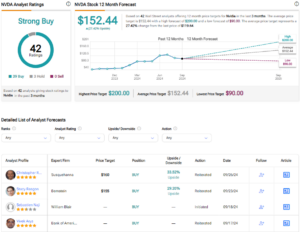

Is NVDA Stock a Buy or Sell, According to Analysts?

Analysts remain bullish on Nvidia, with a consensus rating of Strong Buy and a potential upside in the stock price. The company’s continued focus on AI innovation and market dominance makes NVDA a compelling investment option for those seeking long-term growth opportunities.

Conclusion: Consider NVDA Stock for Its Long-Term AI Potential

As Nvidia continues to lead the way in AI innovation, investors can capitalize on the company’s long-term growth potential. Despite recent fluctuations in the stock price, NVDA remains a solid choice for those looking to invest in the rapidly expanding AI market. By leveraging Nvidia’s expertise in AI and data center solutions, investors can position themselves for success in the evolving tech landscape.