Delta Unveils Premium Cabin Segmentation: A Game-Changer for Luxury Air Travel and Investor Growth Potential

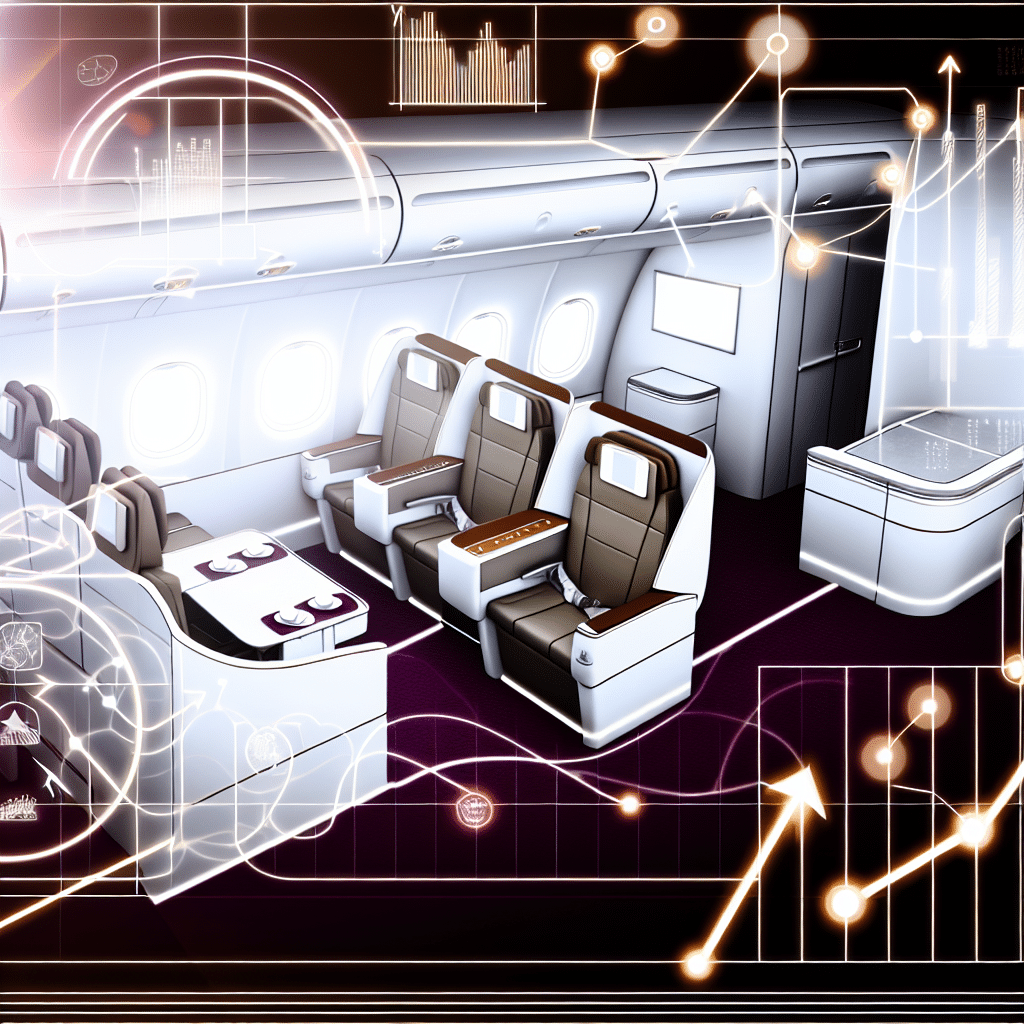

Delta Air Lines is pioneering a fresh approach to premium cabin offerings, signaling a strategic shift that savvy investors and advisors should watch closely. After years of intense segmentation in economy class—think basic economy fares with no seat assignments and extra-legroom upsells—the airline industry’s focus is now pivoting to the front of the plane, where premium cabins are proving to be a resilient profit center even amid fluctuating travel demand.

Delta’s President Glen Hauenstein recently emphasized this trend, highlighting how premium cabins have become the “margin expansion engines” for the airline. Revenue from premium seats, including business class, grew by 6% in the first half of 2024, reaching $10.6 billion, while main cabin economy revenue declined by 4%. This divergence is crucial: it underscores a broader industry pattern where high-end travel is not only holding steady but also commanding premium pricing power. For investors, this means airlines with strong premium product strategies could outperform their peers.

What makes this development particularly noteworthy is Delta’s intention to apply the successful “segmentation” playbook from economy class to premium cabins. This could mean introducing tiered business class tickets with varying levels of perks—potentially creating a new category of “budget premium” fares that might exclude amenities like lounge access or guaranteed seat assignments. While Delta is still testing customer reactions and has not finalized any offerings, the move signals a potential disruption in premium travel pricing models.

From an investor’s perspective, this evolving segmentation strategy could unlock new revenue streams and improve load factors in premium cabins, traditionally seen as less flexible. Airlines like United and American are also investing heavily in premium cabin innovation, with United’s Polaris cabin refresh and American’s new business-class suites on Boeing 787 Dreamliners showcasing a broader industry commitment to enhancing the premium experience.

A unique insight that Extreme Investor Network brings to the table is the potential impact of these premium segmentation strategies on airline loyalty programs. As premium travelers often form the backbone of lucrative loyalty memberships, more granular fare classes could allow airlines to tailor rewards and upsell opportunities more effectively, boosting lifetime customer value. According to a recent report by McKinsey, loyalty program members contribute up to 40% more revenue per trip than non-members, a statistic that reinforces the strategic importance of premium segmentation.

What should investors and advisors do differently now? First, evaluate airline stocks through the lens of premium cabin innovation and loyalty program strength rather than just overall passenger volume. Airlines that successfully monetize premium cabins with tiered offerings and enhanced loyalty incentives are likely to see stronger margins and more stable cash flows. Second, monitor ancillary revenue trends—these new premium fare structures could significantly increase ancillary sales, from seat upgrades to exclusive services.

Looking ahead, the premium cabin could become a battleground for airlines seeking differentiation in a crowded market. Expect more experimentation with seat configurations, social spaces (like Virgin Atlantic’s “Retreat Suite” for intimate group dining), and personalized service tiers. For example, Delta’s CEO Ed Bastian acknowledged the need to upgrade product life cycles, signaling ongoing capital investments in premium cabins that could drive long-term competitive advantage.

In summary, the airline industry’s pivot to premium cabin segmentation is more than a pricing tweak—it’s a strategic evolution with significant implications for revenue growth, customer loyalty, and investor returns. Staying ahead means watching how airlines innovate in premium offerings and loyalty programs, and positioning portfolios to capitalize on these high-margin opportunities.

Sources:

– CNBC, Delta Air Lines earnings call transcripts

– McKinsey & Company, “The future of airline loyalty programs,” 2024

– Airline industry reports on premium cabin trends (United Airlines, American Airlines)

By focusing on these premium trends, Extreme Investor Network readers can gain a unique edge in understanding where the airline industry’s profit engines are truly revving up.

Source: Delta says segmentation coming to high-end cabins