The Shift Back to China: How DeepSeek is Redefining Investment Strategies

In a significant shift in the investment landscape, hedge funds are rediscovering the allure of Chinese equities, driven in part by remarkable advancements in artificial intelligence courtesy of DeepSeek. Over recent months, a resurgence of interest in Chinese markets is evident, with funds pouring back into the region at an unprecedented pace as the optimism surrounding AI technology builds. Meanwhile, India, once considered the darling of equity investors, is witnessing a significant outflow of capital due to concerns over macroeconomic growth and higher stock valuations.

Recent analyses reveal that in just the past month, China’s onshore and offshore equity markets have collectively gained more than $1.3 trillion in value. In stark contrast, India’s market has experienced a decline exceeding $720 billion. The MSCI China Index is set to outperform its Indian counterpart for the third consecutive month—a milestone that has not been seen in two years.

Investment Perspectives: A Move Towards Chinese Tech

Ken Wong, an equity portfolio specialist with Eastspring Investments, notes that DeepSeek is illustrating China’s vital role in the burgeoning AI ecosystem. His firm has strategically increased its stakes in Chinese internet companies while reducing investments in smaller Indian stocks that have outpriced themselves. This reflects a broader sentiment among investors who are becoming increasingly wary of inflated valuations in India.

This new trend represents a reversal from the past few years where Indian markets attracted significant capital in response to ambitious government infrastructure initiatives and geopolitical shifts that painted India as an emerging manufacturing hub. However, the current macroeconomic indicators suggest that the winds of change are favoring China once again.

The Allure of Competitive Valuations

As investment dynamics change, a reevaluation of China’s attractiveness is underway, particularly in the tech sector. Following past corporate crackdowns that unnerved investors, recent signals from Beijing indicate a pivot towards supporting the tech industry, with notable figures like Jack Ma engaging in dialogues with the nation’s leadership. This newfound openness potentially paves the way for a more favorable investment climate, further enhancing China’s appeal.

One of the standout aspects of this shift is the stark difference in valuation between the two indices. The MSCI China Index is currently trading at about 11 times forward earnings estimates, a sharp contrast to the approximately 21 times for the MSCI India Index. This discrepancy not only emphasizes China’s favorable risk-reward proposition but also beckons investors to reconsider their allocations.

Strategic Allocations: The Changing Tides

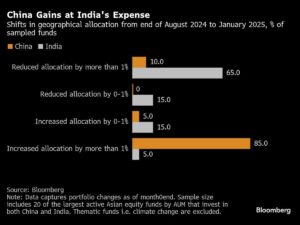

An analysis of regional allocations by leading Asian equity funds shows a tangible decrease in Indian investments in favor of Chinese stocks. In a notably bold move, the Man Asia Ex-Japan Equity fund ramped up its China exposure to 40%, simultaneously decreasing its Indian allocations.

While India’s long-term growth narrative remains bolstered by firms such as Morgan Stanley, which argue that the recent market corrections may be exaggerated, the fear of overvaluation persists. This sentiment is compounded by external pressures, such as additional tariffs imposed during previous administrations, which create an uncertain operating environment for Chinese companies.

Emerging Trends: Cautious Optimism

Despite the excitement surrounding China’s potential rebound, skepticism still lurks among investors. Previous disappointments stemming from unfulfilled growth promises cast a shadow over the current euphoria. Industry experts like Helen Zhu, the chief investment officer at Nan Fung Trinity HK Ltd., express caution, citing unpredictable monetization prospects stemming from DeepSeek’s AI developments.

Yet optimism is palpable, particularly following substantial gains in market values—Alibaba alone added $100 billion in just five weeks. The Hang Seng Tech Index has entered a bull market, fueling speculation that "China’s back" and that investors may be on the cusp of a sustained market resurgence.

Conclusion: Navigating the New Investment Landscape

The resurgent interest in Chinese equities, particularly in light of AI advancements and favorable valuations, hints at a recalibration of investor strategies. While the narrative surrounding India remains compelling, the risk-reward calculus appears to be shifting back in favor of China. As fund managers like Nicole Wong suggest, leveraging this momentum tactically could yield significant returns in the evolving landscape.

As we continue to monitor these developments, it’s clear that understanding the nuances of international markets, especially with emerging technologies like DeepSeek, will be crucial for investors seeking to navigate this complex terrain effectively. For those invested in maximizing their portfolio strategies, staying informed about these shifts is not just advisable; it’s essential.