The Debt Trap: How China’s Lending Practices Shape Global Geopolitics

As the global landscape shifts, the financial practices of nations become pivotal to understanding emerging power dynamics. A recent report from the Lowly Institute highlights a troubling trend for the world’s poorest nations: over 75 of them are deeply indebted to China, with debts nearing a staggering $35 billion. The ramifications of these debts are profound, affecting not just economies but also geopolitical relationships.

China: More Debt Collector Than Banker

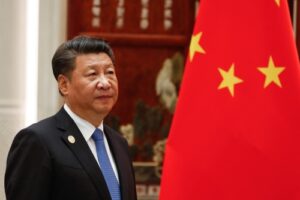

The report asserts that "now, and for the rest of this decade, China will be more debt collector than banker to the developing world." This strategy aligns with President Xi Jinping’s Belt and Road Initiative (BRI), which sought not only to expand China’s influence but also to create a web of financial dependency among developing nations. By 2016, China emerged as the largest supplier of bilateral loans, surpassing all Western creditors combined.

China made headlines with loan totals skyrocketing to $50 billion, but many experts believe the total hidden debt connected to BRI initiatives may eclipse $385 billion—a figure that raises serious questions about the sustainability of such lending practices.

Resources and Risk: The Cycle of Dependency

Nations like Argentina, Brazil, the Democratic Republic of Congo, and Indonesia share a characteristic: abundant natural resources but limited access to international capital markets. Such limitations have made them more susceptible to China’s financial overtures. In 2005, China held a mere 5% of external debt in developing countries; today, that figure has surged to 40%.

According to the World Bank, not only is China the largest supplier of bilateral debt, accounting for over 30% of loans in 2025, but it has also eclipsed the Paris Club bloc in amounts owed by developing nations. Currently, 26% of all bilateral debt among these nations is owed to China, highlighting the entrenched nature of this financial web.

A Crisis of Servicing Debts

The implications are stark: many developing nations are unable to meet their repayment schedules. The International Monetary Fund notes that over half of the world’s most vulnerable nations are in a state of debt distress. Alarmingly, more than 3.3 billion people live in countries that allocate more funds to servicing these debts than to critical sectors like education and healthcare.

Debt-Trap Diplomacy: A Strategic Gamble

China’s lending practices have been critiqued as a form of “debt-trap diplomacy.” By extending loans that many nations cannot afford to repay, China gains substantial leverage over their geopolitical affairs. In the event of non-repayment, countries may find themselves exchanging critical assets—such as military bases, access to infrastructure, or even mineral rights—as collateral.

Take Pakistan, for instance, which has defaulted on debts multiple times yet continues to receive Chinese financial assistance for strategic reasons. In this changing landscape, debt is not merely a financial obligation; it’s a tool for influence.

What Lies Ahead?

As we venture deeper into the complexities of international finance, the question remains: what will the future of these indebted nations look like? Will the cycle of dependency continue, or will alternative solutions arise? At Extreme Investor Network, we are committed to exploring these critical questions. Understanding the implications of such financial practices is vital for both investors and policymakers moving forward.

In an era where economics shapes geopolitics, staying informed can empower nations and investors alike. The trajectory of these developing countries will be closely watched—not just for their economic recovery, but for the broader implications on global power dynamics.

Explore more insights and strategies with us at Extreme Investor Network, where knowledge is our greatest asset.