Are you a single parent struggling to make ends meet after a divorce? You are not alone. Many individuals find themselves in similar financial situations, facing high costs of living and limited incomes. Seeking advice from a financial advisor can be the key to securing your financial future and providing stability for your family during difficult times.

Consider the case of Karen, a single mom from Irvine, California, who called into The Ramsey Show for advice. Despite having $1.3 million from her divorce settlement, she struggles to afford the $8,000 monthly rent on her $5,600 income. The cost of living in Irvine is significantly higher than the national and state averages, making it difficult for Karen to sustain her current living situation.

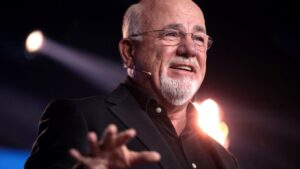

Renowned financial expert Dave Ramsey pointed out the stark reality to Karen – she simply cannot afford to live in one of the most expensive real estate markets in the world. Despite her best efforts to live a basic lifestyle, the financial burden is too great to bear. Ramsey advised Karen to consider relocating to a more affordable area to create a stable environment for her and her children.

According to statistics, about 43% of first marriages end in divorce, with even higher rates for second and third marriages. The median single-parent income in the U.S. is around $43,000, while the average cost of living for a single-parent family is $49,000 per year. These numbers vary based on location, but expenses often exceed income for single parents.

In light of these challenges, seeking professional financial guidance is crucial. Financial advisors can offer personalized advice on managing assets, budgeting effectively, and planning for the future. Many advisors provide free consultations to assess your financial situation and goals, helping you navigate through tough times.

At Extreme Investor Network, we understand the importance of financial stability and security, especially for single parents facing divorce-related financial struggles. Our team of experts is here to provide you with the necessary support and guidance to help you achieve your financial goals and create a secure future for you and your family. Don’t hesitate to reach out to us for professional assistance — your financial well-being is our top priority.