The Impact of Interest Rates and Geo-Political Shifts on Gold and Silver Markets

At Extreme Investor Network, we believe that understanding the dynamics of the stock market extends beyond just following stock prices—it’s about comprehending the broader economic canvas. Recently, market movements for precious metals like gold and silver have illustrated how intertwining factors can dictate investment sentiment. Today, let’s dive into what’s driving these commodities and what it means for investors looking to make informed decisions.

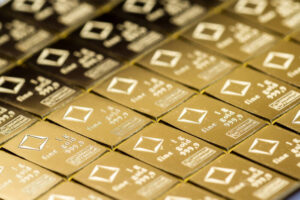

Gold’s Allure Amid Potential Rate Cuts

Anticipation around Federal Reserve interest rate cuts has sparked renewed interest in gold. With speculation mounting that the Fed may implement two rate cuts this year, gold’s appeal grows stronger. Why? Lower interest rates diminish the opportunity cost associated with holding non-yielding assets such as gold. Essentially, when rates dip, the allure of simultaneously earning interest on cash deposits dims, encouraging traders to pivot towards gold, a time-honored store of value.

However, the environment is complex. Recently, a crucial geopolitical development—the suspension of tariffs on goods traded with Mexico and Canada—has rejuvenated investor sentiment towards riskier assets. This bolstered confidence has resulted in rising U.S. Treasury yields and solid gains in equity markets. Consequently, this risk-on sentiment may cap gold’s potential price gains in the short term. Investors should remain vigilant; the interplay between inflation expectations, interest rates, and geopolitical developments will continue to influence market dynamics.

Silver Faces Unique Challenges

As market participants are turning their gaze toward gold, silver (XAG/USD) is encountering headwinds of its own. Currently trading at $31.43, silver recently dipped to an intra-day low of $31.36. Unlike gold, which benefits from the prospect of falling interest rates, silver is feeling the weight of an improved risk sentiment spurred by the tariff pause. The resultant strengthening of the U.S. dollar and surging Treasury yields exerts additional downward pressure on silver prices.

Despite these challenges, it’s important to acknowledge silver’s unique position in the market. As both an industrial and precious metal, silver’s price dynamics often differ from those of gold. Investors should keep a keen eye on upcoming U.S. economic data, as any signs of economic weaknesses could reinvigorate interest in silver, potentially reversing current bearish momentum.

Economic Indicators: A Mixed Bag

Turning to recent economic indicators, the landscape shows signs of resilience. The ISM Manufacturing PMI rose to 50.9 in January from December’s 49.3, surpassing expectations. This uptick is significant as it signals expansion in the manufacturing sector, contrasting with prevailing fears fueled by trade tensions. Strong manufacturing data could initially bolster risk assets and dampen gold’s demand as a safe-haven asset in the short term.

However, at Extreme Investor Network, we emphasize the importance of a diversified strategy. While current conditions may favor equities and bonds, potential volatility and macroeconomic shifts mean that incorporating precious metals into an investment portfolio remains a prudent hedge against uncertainty.

Conclusion

In conclusion, the interplay of interest rates, geopolitical events, and economic indicators creates a complex environment for precious metals like gold and silver. While there may be short-term obstacles, the fundamental principles of investment remain constant: diversification and informed decision-making are your best allies. Whether you’re a seasoned trader or a budding investor, staying informed about these trends will be critical to navigating the markets successfully.

For more insights and updates on market trends, join our community at Extreme Investor Network, where we provide you with the tools and information you need to make educated investment choices. Together, let’s maneuver through the intricate landscape of investments and seize opportunities as they arise!