Is Now the Time to Buy PayPal Stock?

Understanding the Fintech Landscape

Financial technology, or fintech, is revolutionizing how we move money, both between individuals and businesses. At the forefront of this evolution is PayPal (NASDAQ: PYPL) — the original fintech powerhouse. Since its inception in 2000, PayPal has not only weathered the dot-com bubble but has also transformed into a household name with its digital and mobile payments network, alongside its popular peer-to-peer payment app, Venmo.

A Recent Decline

However, it’s no secret that PayPal’s shine has dulled. From its peak in 2021, the stock has plummeted nearly 80%, raising questions: Has PayPal missed its window for growth, or is there still value to find? With newly appointed CEO Alex Chriss at the helm, the company is seeking to reinvigorate its brand and market performance.

A Closer Look at PayPal’s Performance

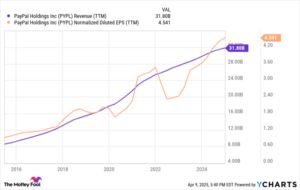

Despite the stock’s decline, PayPal remains a formidable player in the fintech arena, boasting approximately 434 million active accounts across 200 markets and processing $1.68 trillion in payment volume over the past year. However, the company has faced challenges. The increased competition in the payment processing sector has led to a significant erosion of profit margins, with gross margins dipping from around 64% a decade ago to under 46%. Active accounts also plateaued after 2021, signaling a potential stagnation in growth.

Yet, what’s interesting to note is that PayPal has managed to drive both top and bottom-line growth during this tumultuous period. Most companies would struggle under such circumstances, but PayPal has quadrupled its earnings per share over the last decade, a testament to the strength of its core business.

A Bold Future Vision

In its recent investor event, PayPal outlined ambitions to evolve into a full-fledged commerce platform. The focus is to leverage its payment technology and user data to enhance engagement across its user base and merchants. This strategic move aims to encourage more buying, selling, paying, and borrowing on the platform, thus benefiting all stakeholders involved.

Investments in new digital products, such as a recently launched digital advertising segment, alongside existing services like Buy Now, Pay Later (BNPL) and small business loans, are part of Chriss’s vision to diversify the company’s income streams and empower growth.

PayPal has set ambitious earnings growth guidance, predicting 6% to 10% growth by 2025, with aims for low-teens growth by 2027 and at least 20% annualized growth thereafter. Though these targets are aggressive, they reflect a strong belief in the resilience and potential of the company’s framework to facilitate such growth.

Investing Insights: Is PayPal a Value Stock?

Here’s where it gets intriguing: PayPal has transformed into a value stock, currently trading at its lowest valuations on record. With a price-to-earnings (P/E) ratio around 16 and a free cash flow yield exceeding 10%, the stock may present a rare opportunity. There are few other companies at such attractive valuations while possessing the potential for robust long-term growth.

Moreover, PayPal has announced a new $15 billion share repurchase program, which, in conjunction with existing repurchases, amounts to nearly $20 billion, roughly a third of its market capitalization. This aggressive buyback strategy signals management’s confidence in the stock’s intrinsic value and aims to enhance shareholder value by reducing the share count.

The Bigger Picture

While the market capitalization is approaching $60 billion, which may seem large for a "small" investment to generate massive returns, patient investors could find themselves rewarded with meaningful gains in the long haul. Investing in high-quality firms with promising growth potential at reasonable prices is a wise strategy that could ultimately secure your financial future.

Final Thoughts

As you ponder your investment choices, consider this: While PayPal holds merit as a worthy contender for your portfolio, it’s essential to conduct thorough research and analysis. Other high-performing stocks may be drawing attention as well—like those recently highlighted by the Motley Fool analyst team—offering potentially lucrative returns that could outshine PayPal in the coming years.

When considering your investment strategy, remember that purchasing shares in robust, innovative companies at appealing valuations can indeed pave your way to long-term financial prosperity. With evolving strategies and an adaptable business model, PayPal might just have the capacity to deliver significant returns to its shareholders in the future.

Stay tuned to Extreme Investor Network for more insights into navigating the vast world of fintech and investing!