Welcome to Extreme Investor Network!

As cybersecurity threats continue to evolve and become more sophisticated, the importance of protecting internal and customer data has never been greater. With hackers constantly finding new ways to breach systems, companies must take precautions to safeguard their information.

Investors looking to capitalize on the growing demand for cybersecurity solutions should consider adding cybersecurity stocks to their portfolio. Two popular options in this space are Palo Alto Networks (NASDAQ: PANW) and CrowdStrike (NASDAQ: CRWD). But which one presents a better investment opportunity? Let’s dive in and find out.

Palo Alto and CrowdStrike: A Head-to-Head Comparison

Let’s start by examining the core businesses of each company within the cybersecurity sector.

Palo Alto Networks operates in three main segments: network security, cloud security, and security operations. Their offerings include firewalls, zero-trust platforms, cloud workload protection, endpoint security, and threat detection response.

CrowdStrike, on the other hand, initially focused on endpoint protection and has since expanded into identity protection, cloud security, threat intelligence, and endpoint detection response. While both companies offer similar products, CrowdStrike took a cloud-first security approach and has gained a strong foothold in the market.

CrowdStrike’s Strong Growth Projections

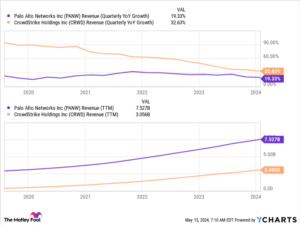

When it comes to revenue growth, CrowdStrike appears to have an edge, especially as a smaller, more agile business. However, as CrowdStrike grows in size, its year-over-year revenue growth rate tends to slow down.

In the most recent quarter, CrowdStrike expects revenue growth of around 31%, signaling a promising outlook for the company. In contrast, Palo Alto Networks anticipates revenue growth of only 3% in the same period, raising concerns about its competitiveness in the market.

While Palo Alto Networks is focusing on accelerating its platformization and AI leadership, CrowdStrike has been leveraging artificial intelligence since its inception to develop advanced cybersecurity solutions. This gives CrowdStrike a significant advantage, particularly in endpoint protection.

Which Stock Should You Choose?

Given CrowdStrike’s track record and commitment to leveraging AI technology, it emerges as the stronger investment choice between the two. With its innovative approach to cybersecurity and strong growth projections, CrowdStrike presents a compelling opportunity for investors.

Investing in cybersecurity stocks like CrowdStrike can provide a hedge against cybersecurity risks and capitalize on the increasing demand for digital security solutions.

Ready to Invest in Cybersecurity Stocks?

Before making any investment decisions, it’s essential to conduct thorough research and consider your financial goals and risk tolerance. At Extreme Investor Network, we provide expert insights and analysis to help you navigate the world of finance and make informed investment choices.

Stay tuned for more exclusive content and expert advice on cybersecurity, finance, and investing. Join the Extreme Investor Network today and take your investment portfolio to the next level!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.