Are you looking for investments that can generate passive income for you? Building a portfolio that provides a steady stream of cash flow can be a great way to achieve financial freedom. While many people turn to the stock market for this purpose, it’s essential to choose the right stocks that offer high dividend yields to maximize your passive income potential.

At Extreme Investor Network, we understand the importance of finding the best dividend-paying stocks to enhance your investment strategy. Many stocks in the market today offer minimal dividends or none at all, making it challenging to generate substantial passive income solely from stock investments. However, there are still opportunities to build a passive income dividend portfolio by selecting carefully chosen stocks with high and reliable dividend yields.

Two stocks that stand out in terms of high dividend yields are Altria Group (NYSE: MO) and Philip Morris International (NYSE: PM). Both companies are major players in the tobacco industry and present compelling opportunities for income investors. But which one is the better choice for passive income seekers?

Let’s dive deeper into the characteristics of each company to determine which stock may be more suitable for your passive income investment goals.

**Altria Group: High Yield from Legacy Tobacco**

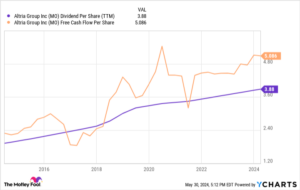

Altria Group, the parent company of Philip Morris USA, is a leading tobacco and nicotine company in the United States. Despite facing challenges such as declining cigarette sales volume, Altria has managed to sustain its earnings growth through strategic pricing adjustments. The company’s consistent earnings growth, coupled with a robust stock buyback program, has resulted in substantial free cash flow per share growth over the years.

Currently, Altria pays an annual dividend of $3.88 per share, yielding an attractive 8.6% at the current share price. With a track record of increasing dividend payments and maintaining a healthy free cash flow, Altria presents a compelling choice for investors seeking high and reliable dividend yields.

**Philip Morris International: Growth in New Nicotine Products**

On the other hand, Philip Morris International operates as the international arm of the Philip Morris brand, serving markets outside the United States. The company’s focus on new-technology nicotine products, such as the popular Iqos brand, has driven revenue growth and mitigated volume declines in its cigarette business. With a dividend of $5.17 per share and a dividend yield of around 5.2%, Philip Morris International offers a slightly lower but still attractive dividend yield for income investors.

Given the company’s innovative product offerings and strong position in the global tobacco market, Philip Morris International presents a compelling case for long-term dividend growth potential.

**Which Stock is the Better Dividend Play?**

While both Altria Group and Philip Morris International offer unique opportunities for income investors, each company has its strengths and weaknesses to consider. Altria boasts a higher dividend yield and more room for dividend growth based on its free cash flow position. However, the company faces challenges in the U.S. cigarette market, which could impact its long-term growth prospects.

On the other hand, Philip Morris International presents a more diversified revenue stream and a solid position in the global tobacco market. With a focus on new-technology nicotine products and stable international cigarette sales, the company is well-positioned for sustained dividend growth in the future.

In conclusion, if you are looking for a reliable passive income investment that you can “set and forget” in your portfolio, Philip Morris International may be the better choice due to its long-term growth prospects and innovative product offerings.

At Extreme Investor Network, we provide expert insights and recommendations on dividend-paying stocks to help you build a resilient and profitable investment portfolio. Stay tuned for more valuable content and financial advice to enhance your investment journey.

**Disclaimer: Brett Schafer has no position in any of the stocks mentioned in this article. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.**

Ready to boost your passive income with dividend-paying stocks? Stay connected with Extreme Investor Network for the latest updates and recommendations on high-yield investments. Enhance your financial future with our expert guidance and unique insights into the world of finance. Join us on this exciting investment journey and make your money work harder for you.