At Extreme Investor Network, we delve into the fascinating world of commodities trading and how it differs significantly from the traditional stock and real estate markets. Take a look at wheat, for example, dating back to 1200, where we see distinct patterns in its trading behavior. Unlike manufactured goods, commodities like wheat are heavily influenced by natural factors such as weather conditions and supply discoveries in mining.

One key example that highlights the unique nature of commodity trading is the impact of historical events like the Black Death on wheat prices. During this time, a 50% drop in population led to a decrease in demand, while a collapse in labor resulted in a decline in production. As a result, prices rose due to a shortage of supply, leading landlords to start paying wages, showcasing the complex trends involved in commodities trading.

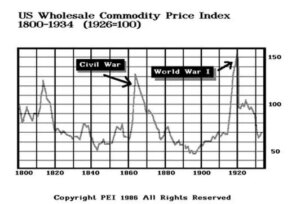

War is another factor that significantly impacts commodities, as seen through various historical events. Interestingly, the role of gold in the market has evolved over time, with its purchasing power fluctuating in response to different economic contexts. When gold was considered as money, it decreased in purchasing power with inflation. However, in a free market scenario, gold behaves more like a commodity and moves opposite to inflation trends.

In the current market environment, we are witnessing a cycle where confidence is wavering, leading to fluctuations in both gold and the stock market. While gold may experience bursts of price increases, it remains a volatile investment, especially when compared to traditional stocks. Understanding these cyclical patterns and timing market events is essential for successful commodity trading, as these bursts in prices often stem from catch-up movements in the international market value of commodities.

At Extreme Investor Network, we provide unique insights and analysis into the fascinating world of commodities trading, helping investors make informed decisions in this dynamic market environment. Stay tuned for more valuable information and expert tips on navigating the complexities of commodity trading.