At Extreme Investor Network, we strive to provide valuable insights and unique perspectives on the world of finance. Today, we are diving into the semiconductor industry and the impact of recent geopolitical tensions on some of the biggest players in the market.

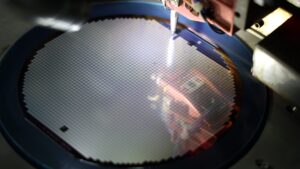

According to a recent report by Bank of America analysts, four of the world’s largest semiconductor equipment manufacturers, including ASML, have experienced a significant increase in their China revenue since late 2022. This surge in revenue can be attributed to China’s accelerated purchase of semiconductor manufacturing equipment following tighter export restrictions imposed by the U.S. in October 2022.

The report specifically highlighted companies such as Lam Research, KLA Corp., ASML, and Applied Materials, whose China revenue more than doubled from 17% of their total revenue in the fourth quarter of 2022 to 41% in the first quarter of 2024. This shift underscores the critical role that technology, especially semiconductors, plays in the ongoing trade tensions between the U.S. and China.

As the U.S. considers broader restrictions on semiconductor equipment exports to China, investors are closely monitoring the situation. The VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, has seen fluctuations in the market but is still holding gains of nearly 46% for the year so far.

At Extreme Investor Network, we believe that staying informed and understanding the implications of geopolitical events on the financial markets is essential for successful investing. Keep an eye on our website for more expert analysis and valuable insights to help you navigate the ever-evolving world of finance.