Chinese Tech Stocks: A Resilient Comeback Amid Geopolitical Turmoil

Recently, Chinese technology stocks have shown notable resilience, partly attributed to mainland investors who are doubling down on their bets amid rising geopolitical tensions. As the market reacted to U.S. President Donald Trump’s latest measures aimed at restricting investments between the U.S. and China, the Hang Seng Tech Index, which had dipped significantly, quickly rebounded thanks to an influx of over $1 billion into Hong Kong stocks from Chinese investors.

In recent weeks, concerns surrounding U.S. investment policies have weighed heavily on Chinese equities, causing the Hang Seng Tech Index to tumble by as much as 4.4%. However, by 1 p.m. on a recent trading day, this decline was largely mitigated as investors sought to seize seemingly undervalued assets in the tech sector. According to data, mainland buyers have amassed a staggering net worth of approximately HK$225 billion ($28.9 billion) in Hong Kong stocks this year alone, highlighting their commitment to the market.

A Renewed Focus on Artificial Intelligence

Mainland investors are increasingly placing their bets on China’s ambitions in artificial intelligence (AI), aligning their strategies with the priorities set forth by President Xi Jinping in the ongoing U.S.-China tech rivalry. Interestingly, while the AI sector is gaining traction, American Depositary Receipts (ADRs) of major Chinese firms have encountered a 5% decline due to escalating fears about heightened scrutiny on these companies by the Trump administration.

Zhuang Jiapeng, a fund manager at Shenzhen JM Capital Co. emphasized that current market conditions present an evident buying opportunity. "It’s an obvious time to buy stocks without even having to do calculations," he stated, underscoring the belief that now is not the moment to unload positions in Chinese tech.

The Impact of U.S. Policy

Trump’s recent directives have renewed concerns about geopolitical risks that had been relatively overlooked until now. Chinese internet giants had recently experienced robust growth, instilling confidence in their long-term potential. This momentum provides a stark contrast to the turbulence faced by their U.S. counterparts, particularly for ADRs, which suffered significant losses as geopolitical tensions escalated.

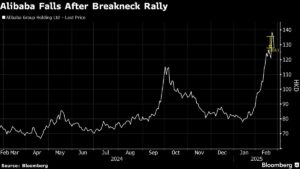

Market analysts highlighted the sharp disparities between the performance of companies like Alibaba in the U.S. and Hong Kong markets. For example, while Alibaba’s ADRs plummeted by 10%, its shares on the Hong Kong stock exchange were able to limit losses to just under 3%. The discount between Alibaba’s ADRs and its Hong Kong counterpart also reached its widest margin since May 2022, suggesting that investors are watching for price efficiencies that might emerge as the market stabilizes.

The Road Ahead

Despite these fluctuations, the Hang Seng Tech Index has realized a substantial gain of around 29% since the beginning of the year, as optimism over tech’s potential resurfaces. Analysts suggest that the sector is at a pivotal stage, especially following high-profile discussions between President Xi and leaders from China’s tech industry. Zeng Wenkai, managing director at Shengqi Asset Management Co., noted that the current market conditions resemble the early stages of the Nvidia rally in late 2023. This comparison highlights the belief that the journey for Chinese AI technology is far from over and that potential growth remains significant.

It is evident that while uncertainty looms due to geopolitical developments, there’s a growing optimism among investors who view this as a strategic opportunity for long-term investments in the Chinese tech sector. As we continue to monitor these trends, we encourage investors to consider the emerging narratives that could redefine the landscape for technology in China, ultimately reshaping the investment strategy for both local and global portfolios.