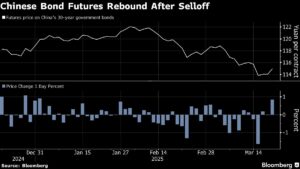

Chinese Government Bonds Show Signs of Recovery: What This Means for Investors

In recent days, the bond market in China has shown notable signs of recovery, buoyed by significant actions from the People’s Bank of China (PBOC). The central bank’s boost in short-term funding support has directly influenced bond yields, leading to a marked decline in yields on government securities. For instance, yields on the benchmark 10-year note decreased by 3 basis points, settling at 1.84%. This is the third consecutive day of yield declines, a trend that suggests a potential shift in market sentiment.

What’s Driving the Recovery?

The recent market movements are largely due to aggressive liquidity injections by the PBOC. Over just four days, the bank has infused approximately 973.2 billion yuan (around $134.6 billion) via short-term policy loans. This marks a notable departure from earlier trends where the PBOC had been more cautious, opting to drain liquidity from the financial system for nearly two weeks. This latest influx reflects heightened official concerns regarding the recent bond market turmoil, which was precipitated by both efforts to stabilize the yuan and a significant rally in Chinese stock markets.

With the U.S. dollar recently softening, Chinese policymakers find themselves in a more comfortable position to support borrowing costs. This is essential as they aim to achieve ambitious economic growth targets amidst an increasing burden of debt issuance.

Analysts Weigh In

Analysts from Huaxi Securities, led by Liu Yu, have voiced optimism about the bond market’s prospects. They state that continuing liquidity injections from the PBOC are pivotal in preventing further sell-offs in the debt market, potentially re-establishing investor confidence. The overall sentiment is that this support could usher in a moderately bullish phase for Chinese government bonds, an essential shift for investors navigating the current economic landscape.

The Bigger Picture: Economic Growth and Debt Levels

It’s noteworthy that China’s annual supply of new government bonds is projected to increase to 11.86 trillion yuan in the coming year. This increase follows a decision by officials to raise the general budget deficit target to about 4% of GDP—the highest level observed in over three decades. These factors collectively signal the government’s willingness to invest heavily in economic recovery and stabilization efforts.

What Does This Mean for Investors?

For bond investors, the current trend indicates a potential opportunity for strategic positioning within the Chinese bond market. However, it also comes with risks, particularly considering the PBOC’s historically cautious stance on liquidity management. The ongoing dynamics in the money market, combined with the government’s expanding deficit, necessitate a vigilant approach for investors. While there is potential for recovery, any missteps in economic management or further international pressures could disrupt these gains.

Conclusion

As the PBOC works to stabilize the market amidst a backdrop of rising debt levels and liquidity challenges, investors should remain alert to the underlying economic indicators and monetary policy shifts. The evolving bond landscape not only reflects internal economic conditions but is also shaped by global market movements, making it imperative for investors to stay informed and proactive.

At Extreme Investor Network, we understand that navigating the complexities of the global finance landscape can be daunting. Our commitment to delivering timely insights and expert analysis empowers our readers to make informed investment decisions. Stay connected with us for updates and strategies that can enhance your investment journey in these turbulent times.