In the world of finance, every small detail can make a big impact. That’s why at Extreme Investor Network, we pride ourselves on providing cutting-edge information to help our readers stay ahead of the game.

Recently, Asian shares experienced a significant decline due to concerns over China’s debt swap program and ongoing deflationary pressures in the economy. This news sparked a 1.3% drop in a gauge of the region’s equities, with heavyweights like Tencent Holdings and Meituan leading the way. Additionally, Taiwan Semiconductor Manufacturing Co. saw a decrease after reports that the US had instructed them to stop shipping advanced chips to Chinese customers.

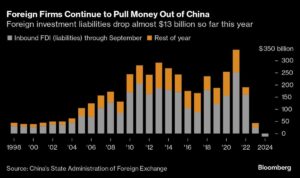

China’s CSI 300 onshore benchmark faltered by 1.4%, highlighting the lingering doubts about the country’s economic future. Despite unveiling a massive 10 trillion yuan program to address local government debt risks, Beijing refrained from implementing new fiscal stimulus measures. This move, combined with sluggish inflation and declining foreign direct investment, has left investors wary about China’s economic trajectory.

In light of these developments, there is growing uncertainty around how China will navigate potential challenges such as a trade war in the wake of Donald Trump’s presidency. Economists are closely watching for any shifts in Chinese policy that could impact global markets.

At Extreme Investor Network, we understand the importance of staying informed about market movements and economic trends. Our experts analyze these events to provide our readers with valuable insights and actionable advice to navigate the ever-changing financial landscape. Stay connected with us for the latest updates and in-depth analysis on all things finance.