Welcome to Extreme Investor Network, where we provide you with unique insights and analysis on the economy and financial markets. Today, we will be discussing the recent actions of China in the US debt market and how it may impact interest rates.

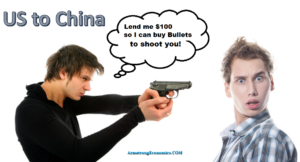

Recent data has shown that China, the largest holder of US debt, has been selling off a record amount of Treasury and US agency bonds in the first quarter. This move by Beijing highlights their strategy to reduce exposure to US debt amid escalating geopolitical tensions. In fact, China dumped a total of $53.3 billion of Treasuries and agency bonds in the first quarter, with Belgium also disposing of $22 billion of Treasuries during the same period.

This significant shift in China’s holdings of US debt raises an important question – will interest rates decline? As China reduces its holdings of US debt, there could be downward pressure on bond prices, leading to an increase in yields and potentially higher interest rates. This development has important implications for investors and policymakers alike, as higher interest rates can impact borrowing costs, investment decisions, and overall economic growth.

At Extreme Investor Network, we will continue to monitor the situation closely and provide you with expert analysis on how these developments in the US debt market may influence the broader economy. Stay tuned for more updates and valuable insights on the financial markets from our team of experts.