Navigating China’s Economic Challenges: Insights from the Extreme Investor Network

As global economic tides shift, the focus turns to the world’s second-largest economy—China. Recent developments have raised questions about how the nation plans to overcome mounting pressures, and the stakes couldn’t be higher for investors looking to navigate these waters. In this blog post from Extreme Investor Network, we delve deeply into the latest strategies announced by Chinese President Xi Jinping and the implications for businesses and investors alike.

China’s Economic Stance: Proactive Measures Ahead of External Shocks

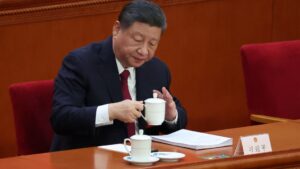

On March 5, 2025, President Xi Jinping chaired a significant meeting of the Politburo, the powerful political entity responsible for guiding China’s direction. The message was clear: the Chinese government intends to roll out targeted measures to assist businesses feeling the heat from an increasingly challenging global environment. This commitment signifies a robust response as tensions between Washington and Beijing reach new heights, marked by tariffs exceeding 100%.

As major Wall Street players reevaluate their GDP forecasts for China, the government remains steadfast in its aim to achieve “around 5% growth”—a target that is ambitious given the recent strains. Authorities emphasize the urgency of introducing multiple measures to support struggling enterprises, including financial backing and other assistance programs tailored to specific sectors.

Policy Insights: Interest Rates and Regulatory Flexibility

The Politburo’s readout underlined plans for a timely reduction in interest rates and adjustments to the reserve requirement ratio—essentially the amounts that banks must maintain in reserve. Such moves highlight the government’s willingness to exercise flexibility as it responds to the shifting economic landscape. Zong Liang, Chief Researcher at the Bank of China, emphasizes the government’s more nuanced approach: understanding the specific impacts of tariffs on various industries and offering tailored support initiatives.

This adaptive economic strategy runs parallel to a significant rise in China’s deficit target to 4% of GDP established earlier this year, suggesting that the government is prepared to wield fiscal policy as a lever for growth.

Shifting Focus: Domestic Consumption and Tech Development

The Politburo meeting also spotlighted crucial areas for fostering resilience, emphasizing the necessity of enhancing the incomes of middle and lower-income groups, while stimulating consumption in service industries. Furthermore, there’s a push for further tech advancements—including the integration of artificial intelligence—aiming to bolster competitiveness on the global stage.

With a swift response plan, the government signals readiness for policy innovation when external shocks sway economic stability. However, according to Zhiwei Zhang of Pinpoint Asset Management, it suggests a thoughtful approach rather than immediate widespread stimulus. Navigating the trade shock requires careful assessment of various economic variables, reinforcing the need for informed decision-making in a volatile landscape.

Integration and Policy Coordination

Interestingly, the CSI 300 index’s brief downturn and the Hang Seng Index’s trimmed gains post-meeting reflect market apprehensions about policy efficacy. The Politburo’s reaffirmation of existing policies underscores a commitment to high-level collaboration that may not yield immediate groundbreaking surprises yet equips policymakers with essential tools.

As China’s National People’s Congress meets soon to review new laws aimed at bolstering the private sector, investors keenly await potential updates that may enhance the business environment.

Conclusion: The Road Ahead for Investors

For investors, the road ahead in China is paved with both challenges and opportunities. Understanding the nuanced economic policies being enacted is crucial for positioning your portfolio to benefit from these changes. At Extreme Investor Network, we are dedicated to providing exclusive insights and analysis to empower you in steering through the complexities of international finance.

Stay tuned as we continue to monitor these developments closely, ensuring that you have the information and strategies necessary to make informed investment decisions. Together, let’s navigate these transformative times in China’s economic landscape!