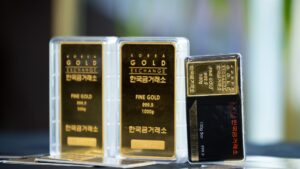

Are you looking to diversify your investment portfolio beyond traditional equities and into commodities like gold? If so, you might want to pay attention to the recent performance of gold compared to the S&P 500 and Nasdaq. Despite the major equity averages reaching new milestones, gold has actually outperformed both so far in 2024.

Historically, gold stocks tend to be closely tied to the performance of the underlying commodity. However, there are periods of dislocation where gold and gold miners may appear more disconnected. For example, in the first quarter of 2024, physical gold was fairly flat while gold miners were sold off into a February low. This disconnection seems to be correcting itself, as seen in the chart of the VanEck Vectors Gold Miners ETF (GDX) which is now testing previous highs.

If GDX breaks above the $36 level, it could imply a retest of the 2022 high around $41, representing another potential 15% gain beyond current levels. Keep an eye on individual gold stocks like Royal Gold (RGLD) which are showing early signs of breakouts. A breakout above resistance levels could indicate a strong influx of buying power and potential for further upside.

What’s exciting about gold is its differentiated return profile from growth stocks, which dominate equity benchmarks. With the current strength in the charts of physical gold and gold miners, this sector may present a compelling opportunity, particularly as we head into the summer months.

At Extreme Investor Network, we understand the importance of staying ahead of market trends and identifying unique investment opportunities. Whether you’re a seasoned investor or just starting out, exploring commodities like gold can help diversify your portfolio and potentially enhance returns. Stay informed, stay ahead, and consider the potential benefits of adding gold to your investment strategy.