The Nuclear Energy Revolution: Powering the Future of AI

The nuclear energy sector is experiencing an unprecedented resurgence, a trend driven by the skyrocketing demand for sustainable and reliable energy to power the AI revolution. Major tech behemoths like Meta, Microsoft, and Alphabet are in fierce competition to secure dependable energy sources for their expanding data centers. Given nuclear power’s clean and consistent energy output, it has become a pivotal player in this race.

Key Players in the Nuclear Energy Revival

Leading this nuclear renaissance are three standout companies: Constellation Energy (CEG), Oklo (OKLO), and NuScale Power (SMR). Each of these firms brings unique strengths to the nuclear landscape, capturing investor attention as energy demands surge.

Constellation Energy: The Industry Powerhouse

Constellation Energy is a titan in the U.S. nuclear landscape, recently capturing headlines with a groundbreaking 20-year power purchase agreement with Meta. Set to start in 2027, this deal involves delivering a staggering 1.1 gigawatts from its Clinton Clean Energy Center in Illinois, a crucial lifeline for a plant that faced closure due to expiring zero-emissions credits. Furthermore, this contract enhances Clinton’s output by 30 megawatts and illustrates Constellation’s expertise in securing deals with tech giants. Notably, Microsoft is also investing in the Three Mile Island restart.

What sets CEG apart is its vast infrastructure: the company operates 94 reactors across the U.S., making it a prime partner for tech companies aiming for net-zero objectives while powering intensive AI workloads. This adaptability is essential, especially given the recent regulatory hurdles impacting their plans.

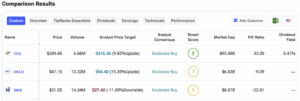

Analysts are broadly optimistic about CEG’s stock performance, currently rated as a Moderate Buy. Despite a 30% increase in stock value year-to-date, predictions suggest further growth, with an average price target reflecting around 10% upside in the coming year.

Oklo: The Innovative Challenger

Emerging as a dynamic new player, Oklo focuses on small modular reactors (SMRs), designed to meet the specific energy needs of data centers. With high-profile agreements, including a December deal to supply 12 gigawatts to Switch through 2044, Oklo’s stock has skyrocketed by an impressive 440% this past year.

Backed by notable figures like Sam Altman of OpenAI, Oklo is developing a "power-as-a-service" model that allows companies to access nuclear-generated energy without significant upfront costs. However, challenges remain, including extensive R&D timelines and high production costs.

Currently, analysts lean towards a Moderate Buy consensus for Oklo, reflecting an average price target with a potential upside of around 15% over the next year. For investors convinced that SMRs will play a crucial role in the AI energy landscape, Oklo presents an intriguing opportunity.

NuScale Power: The Regulatory Leader

NuScale Power is distinguished as the first U.S. company to secure Nuclear Regulatory Commission (NRC) approval for its SMR technology, specifically its 77-megawatt VOYGR module. The company is rapidly advancing towards a substantial 2-gigawatt agreement with Standard Power aimed at supplying data centers in Pennsylvania and Ohio.

Despite experiencing losses as it expands its supply chain, NuScale has reported a staggering 857% year-over-year revenue increase. Its partnership with major clients like Meta further signals strong market confidence in its potential.

NuScale’s approach prioritizes proven technologies, which may give it a near-term advantage. Nevertheless, operational risks and supply chain complexities could present hurdles moving forward. Analysts generally maintain a bullish outlook, designating NuScale with a Moderate Buy rating, though its average price target signifies slight downside potential in the coming year.

The Future of Nuclear Energy

The renaissance of nuclear energy isn’t coincidental; it’s a direct response to the growing energy demands fueled by AI. With Constellation Energy providing scale, Oklo pushing the envelope on innovation, and NuScale establishing regulatory leadership, the potential for long-term growth in this sector is substantial.

Despite each company facing distinct challenges—such as CEG’s high stock valuations, Oklo’s cash burn, and NuScale’s operational risks—their collective advancements position them at the forefront of a transformative energy revolution. With projections indicating a quadrupling of nuclear capacity by 2050, investors would do well to keep a close eye on these dynamic players in the energy market.

Join Extreme Investor Network to stay ahead of the curve and gain exclusive insights into the evolving landscape of nuclear energy and its vital role in the future.