The Flight to Quality: A Misnomer in Today’s Financial Landscape?

In recent times, an intriguing analysis by Allianz economists stirred discussions in financial circles, positing that under normal circumstances, rising Treasury yields usually translate to a strengthening U.S. dollar as global investors flock to higher returns. However, in a surprising twist, the U.S. dollar weakened alongside rising yields. The Allianz economists suggested this phenomenon indicates significant sell-offs of Treasuries by major holders, who then converted their proceeds into foreign currencies—potentially moving their capital to markets in Europe.

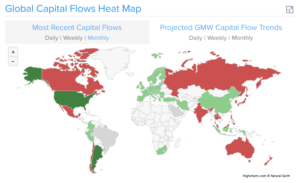

A Closer Look at Capital Flows

At Extreme Investor Network, we aim to provide you with insights that go beyond the surface. While the Allianz perspective raises valid points, let’s analyze the situation with a key understanding of the fundamental differences between the U.S. and European markets. For instance, consider that the total market capitalization of the New York Stock Exchange (NYSE) surpasses that of all European exchanges combined! The stark reality is that U.S. consumer spending is a dominant force in the global economy—accounting for 25% during low points, while Europe lags significantly.

While economists often theorize about capital flows based on interest rates, let’s not forget that traditional economic education can sometimes overlook real-world complexities. The idea that lower interest rates in the U.S. might drive capital back to Europe recalls historical precedents, such as the 1927 G4 meeting where Britain, France, and Germany sought lower rates from the NY Fed. Instead of revitalizing Europe, that move confirmed a deepening debt crisis, resulting in an even greater influx of capital into U.S. markets.

The Reality of Capital Allocation

The assumption that capital will flow into European securities when U.S. yields rise reveals a misunderstanding of modern finance. Eurozone markets are often perceived as too volatile, affected by various social and economic policies that deter large-scale investments. The recent actions of investors indicate a desire for stability and determinacy, rather than the perceived risk associated with European debt, especially against the backdrop of geopolitical instability.

China’s decreasing holdings of U.S. debt since the escalation of the Ukrainian crisis emphasize this point. The geopolitical environment can significantly influence investment decisions. Capital flows are complex and multifaceted—often driven by an intricate interplay of geopolitical fears and economic realities.

Dissecting Market Narratives

Moreover, the tone of financial reporting can shape perceptions. As seen in commentary from establishment media like Bloomberg, there’s a tendency to push narratives aligned with political agendas, often overshadowing genuine economic analysis. Claims that President Trump’s policies might jeopardize U.S. financial dominance ignore the nuances of global economic dynamics—overstepping solid economics for sensationalism.

Fear-based market narratives both distract investors and can lead to poor investment decisions. As geopolitical tensions rise globally—whether in Europe or Asia—investors must critically evaluate the fundamentals of the markets they’re navigating.

Embracing a Holistic View

At the Extreme Investor Network, we emphasize the importance of a well-rounded perspective when analyzing economic trends. Rather than simply following mainstream narratives, we encourage investors to explore the underlying factors affecting those narratives.

In conclusion, the so-called “flight to quality” may not be a one-size-fits-all scenario. We believe that while investors always seek safe havens, their choices are driven more by the intricate realities of global economics than by conventional wisdom. As we navigate these turbulent waters, arm yourself with facts and insights that go beyond the headlines. Understanding the nuanced interplay between geopolitical tensions, market fundamentals, and investor psychology will only serve to make your investment strategies more robust in an ever-evolving landscape.

Stay informed with Extreme Investor Network, where we unravel the complexities of today’s economy so you can make more informed investment decisions.