The Shifting Currents of Global Capital Flows: Insights from Extreme Investor Network

Understanding the flow of capital around the globe is crucial for investors and economists alike. As an expert collective at Extreme Investor Network, we take a deep dive into recent observations that might just reshape your investment strategies.

Unpacking Capital Movements: What’s Really Happening?

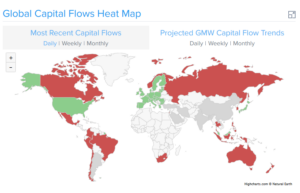

A recent analysis highlighted a common misconception: the narrative that capital is merely fleeing from the United States to Europe is overly simplistic and misleading. While there are undeniable pressures on both sides of the Atlantic, the reality is that capital is not just on the move; it’s preparing for uncertainty that looms on the horizon.

Martin Armstrong’s models continue to shine in the world of economic analysis. His insights date back to the early 1990s, where he pioneered an understanding of capital flows that others are only now beginning to grasp. At Extreme Investor Network, we believe acknowledging and adapting to these models is not just wise; it’s essential for any strategist hoping to thrive in volatile times.

The Reality of European Intimidation

As noted by some analysts, European institutions face unique pressures to repatriate cash and investments. These pressures stem from regulatory threats that loom large for institutional investors. However, it’s important to differentiate between institutional challenges and the broader trends affecting individual and corporate capital flows.

Did you know? Many affluent individuals are actually reallocating assets into safer havens, driven by geopolitical uncertainties. This isn’t just about moving cash across borders; it’s a strategic maneuver to safeguard wealth.

Domestic Dynamics: Canada and Mexico at a Crossroads

As we look to North America, significant shifts are also emerging. Claudia Sheinbaum, the newly elected president of Mexico, is navigating uncharted waters in her relationship with the United States. Her leadership style contrasts sharply with what many anticipated, especially in light of rising tensions regarding drug cartels and cross-border relations.

However, the narrative isn’t just about political bravado—capital is actively responding to these uncertainties. Many investors are becoming wary of the situation in Mexico, leading to a withdrawal of funds from the country based on speculation of upcoming conflicts.

Canada: A Struggle for Economic Stability

Meanwhile, Canada’s political climate reflects a nation in flux. The newly reinstated Prime Minister Carney is focusing on a theme of "resistance," but many experts at Extreme Investor Network question the effectiveness of that strategy. What does "resist" mean in a practical sense? More tariffs? Increased regulatory scrutiny?

The idea that Trump’s administration might annex Canada remains unsubstantiated and largely dismissed by legal experts. However, this fear-mongering has contributed to a climate of uncertainty that directly impacts capital flows. The population is not just fleeing—there’s a palpable migration of both capital and talent as citizens seek more stable ground.

Strategic Insights for Investors

So, where does this leave the informed investor? At Extreme Investor Network, our recommendation is clear: staying ahead means understanding the macroeconomic forces at play and utilizing tools like Socrates, which provide data-driven analysis free from bias.

In turbulent times, knowledge is your best asset. We encourage you to explore, question, and prepare. By investing in reliable insights and real-time analysis, you become more than just a participant in the market; you become a decisive player, ready to navigate the complexities of today’s global economy.

Final Thoughts

The world of capital flows is as complex as it is crucial. Be wary of oversimplified narratives and understand that your investment decisions hinge on a myriad of factors, many of which are constantly changing. Connect with Extreme Investor Network for deeper analysis, real-time data, and the tools you need to become a savvy investor in this dynamic landscape.

Stay informed. Stay invested. And most importantly, navigate wisely.