Navigating Canada’s Trade Barriers: A Call for Change

Insights from Extreme Investor Network

In a time of increasing globalization and fierce international competition, the topic of trade barriers has come to the forefront of economic discussions. Recently, Stéfane Marion, the chief economist at the National Bank of Canada, made headlines by urging the Canadian government to reevaluate its own trade barriers. This plea comes amid criticism of Donald Trump’s proposed tariffs, underscoring a critical conversation about Canada’s internal trade landscape.

Addressing Internal Trade Barriers

In a 2019 study, the International Monetary Fund (IMF) pointed out that Canada has some of the most significant internal trade restrictions. Ironically, rather than reinforcing economic resilience, many of these barriers inhibit domestic corporations while the country strives to attract foreign investments. Marion’s insights reveal a worrying trend: over recent decades, the proportion of interprovincial trade relative to international trade has fallen from 50% to just 40%.

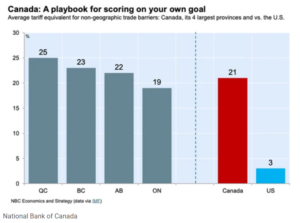

At Extreme Investor Network, we believe that it’s crucial to emphasize how this decline affects the Canadian economy. The red tape surrounding domestic trade is a major hurdle, making it up to 21% more expensive for Canadian firms to operate compared to their American counterparts, where those internal trade barriers represent only about a 3% tariff.

The Global vs. Domestic Trade Dilemma

Canada has forged trade agreements with over 40 nations since signing its first free trade deal with the USA in 1989, aiming to integrate into the global economy. While these international efforts are commendable, they appear to overshadow the pressing need for internal reform. Marion highlights a significant imbalance: while Canada’s international trade strategy has evolved, progress in reducing internal trade barriers has been disappointingly stagnated.

As the Canadian Federation of Independent Business (CFIB) argues, it’s paradoxical that small firms in Canada face fewer obstacles when trading abroad than when dealing with provinces within their own country. Chorine Pohlmann, the CFIB’s executive vice president of advocacy, emphasizes this point, stating, “It’s ridiculous that it’s still easier for Canadian small firms to do business overseas or across the border than within their own country.”

A Call for Fresh Leadership

With Canadians increasingly disillusioned by the current government’s handling of trade issues, there is a growing demand for fresh leadership. The potential implementation of Trump’s 25% tariffs on Canadian goods would have devastating implications on both the U.S. and Canadian economies. However, it is also profoundly clear that Canada’s own trade policies must undergo a reevaluation.

Solutions for Prosperity

At Extreme Investor Network, we advocate for a multi-pronged approach to enhance domestic business operations without imposing further penalties on Canadian companies. First, the government must streamline regulations and reduce the complexity of interprovincial trade. Second, it should prioritize the elimination of unnecessary red tape that disproportionately burdens local businesses. Third, fostering an environment that encourages innovation and investment at home will ensure that Canadian companies thrive and remain competitive, both internationally and domestically.

In conclusion, Canada stands at a crossroads. The challenges presented by internal trade barriers call for urgent action and bold policy changes. The balance between international ambition and domestic support isn’t merely a choice; it’s a necessity for Canada’s economic future. Embracing this change is essential not only to bolster the country’s internal market but also to solidify Canada’s standing on the global stage.

Stay tuned to Extreme Investor Network as we continue to unravel these complex economic issues and provide you with insights that matter. Your investment journey deserves knowledge and clarity, and we’re here to help you navigate it!