The US bond market, after a two-month frenzy of selling, is starting to show signs of recovery. With investors demonstrating a renewed interest whenever Treasury yields test new highs, the dynamics within the bond market are shifting significantly.

The Recent Surge in Treasury Yields

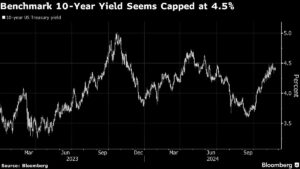

In the wake of Donald Trump’s recent presidential victory and persistently high inflation rates, the benchmark 10-year Treasury yields have seen a significant increase since mid-September. With yields surpassing 4.5% on November 15, they have since reversed slightly, closing at 4.4%, down 3 basis points from the previous week. This newfound stability indicates a cautious optimism among investors, suggesting that the level may now serve as a critical support point.

Investment Strategies Amid Market Volatility

Fund managers at Pacific Investment Management Co. (PIMCO) view these yields as an attractive investment option. They note that the government debt is taking on its traditional role as a hedge against stock market downturns, particularly due to the negative correlation that often exists between stocks and Treasuries. According to Erin Browne of PIMCO, Treasuries present an attractive low volatility asset with a respectable return, especially if the 10-year yield approaches 5%. Such a rise would likely entice more aggressive buying from prudent investors.

Market Reactions to Economic Indicators

Despite expectations that the bond market would prosper following the Federal Reserve’s interest rate cuts, the reality has been more tumultuous. Instead of rallying, yields have increased due to robust economic data and political developments. The market is currently watching closely for the Fed’s preferred inflation measure— the personal consumption expenditure price index—set to be released soon. This report could be pivotal, particularly given the thin trading volumes anticipated around the Thanksgiving holiday, potentially leading to larger price movements based on the data.

Understanding the Broader Economic Impact

Subadra Rajappa, head of US rates strategy at Societe Generale, articulates that while there’s a lack of strong conviction for significantly higher yields, the market is also not set for a considerable rally. Many investors are approaching this environment with caution, reflecting a wait-and-see mentality in light of ongoing economic data releases and uncertainties surrounding Trump administration policies.

Portfolio manager Felipe Villarroel from TwentyFour Asset Management has settled on a fair value range for the 10-year yield between 4.25% and 4.5%, but notes that the inflation landscape continues to evolve, and with it, the volatility in the market is expected to persist.

What’s Next for Investors?

As the market braces for a week packed with economic data releases, traders should prepare for the potential shifts that such insights might bring to Treasury yields. Economic indicators continue to hold weight, and the anticipation of stimulus measures or significant fiscal changes could further affect bond prices.

In this intricate landscape, here are key upcoming events to watch:

Economic Data Releases:

Nov. 25:

- Chicago Fed national activity; Dallas Fed manufacturing activity

Nov. 26:

- Philadelphia Fed non-manufacturing; FHFA house price index; consumer confidence reports; and various manufacturing indices

Nov. 27:

- MBA mortgage applications and GDP updates among other significant reports

Auction Calendar:

Nov. 25 & 26:

- Series of short-term bills and notes will be auctioned, indicating ongoing government financing strategies.

With the backdrop of fluctuating Treasury yields, political shifts, and changing economic realities, investors must remain alert to the signals and insights generated by these updates. By strategically assessing the market, leveraging informed analysis, and staying ahead of economic trends, investors can navigate the evolving bond market landscape successfully.

At Extreme Investor Network, we equip our readers with the insights and tools needed to make informed decisions, ensuring you stay ahead in the ever-changing world of finance. Stay tuned for further analysis as these developments unfold.