BofA Flags Kenvue as a Prime Investment Opportunity Amid Tylenol Controversy, Signaling Potential Market Upside for Savvy Investors

Kenvue’s Recent Sell-Off: A Rare Buying Opportunity or a Red Flag? Here’s What Investors Need to Know

Bank of America’s latest stance on Kenvue is a bold one—and it’s worth paying attention to. Despite a turbulent year marked by a 12.8% decline in shares and a sharp drop following alarming headlines, the firm’s analyst Anna Lizzul is doubling down on her bullish outlook. She’s reaffirmed a Buy rating with a $25 price target, implying a potential upside of over 34%. But what’s driving this conviction, and what should savvy investors do now?

Why Bank of America Sees Value in Kenvue

Kenvue, the consumer health giant behind household names like Tylenol, Motrin, Band-Aid, Aveeno, and Neutrogena, has faced headwinds recently. The stock’s sell-off accelerated after reports surfaced suggesting a possible link between Tylenol use during pregnancy and autism spectrum disorders (ASD). This news, stemming from an upcoming Health and Human Services (HHS) report, rattled investors and sent shares tumbling.

However, Lizzul points out that this isn’t new territory for Kenvue. The company already navigated similar litigation concerns in 2023, with the U.S. Food and Drug Administration (FDA) reaffirming that current scientific evidence does not support a causal relationship between acetaminophen use in pregnancy and ASD or ADHD. From a risk management perspective, this suggests the market’s reaction may be an overcorrection, presenting a compelling entry point.

Valuation and Growth Outlook: Discounted for a Reason?

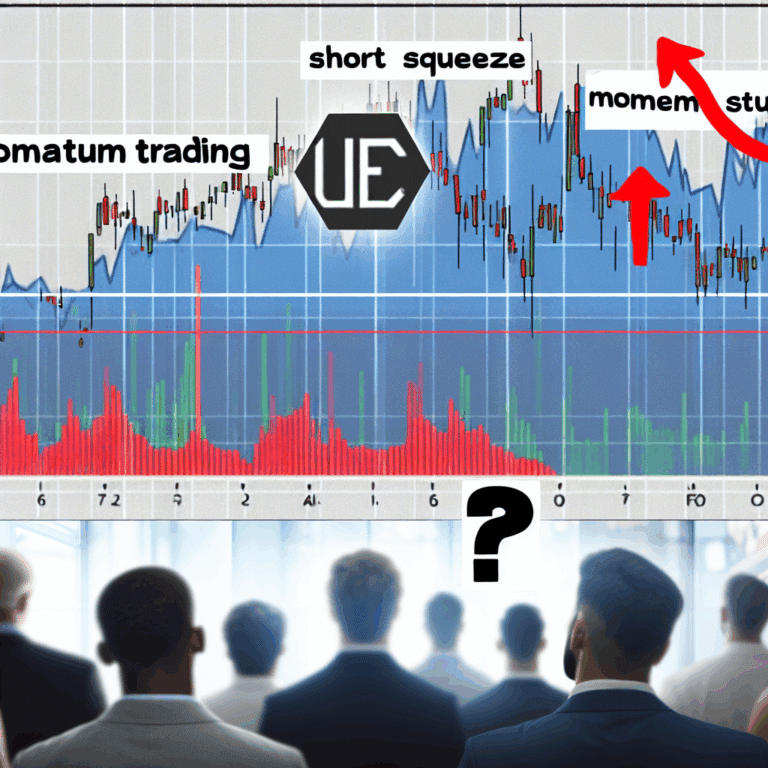

Kenvue is currently trading at an 11x EV/EBITDA multiple for calendar year 2026 estimates, which Lizzul argues is a discount compared to its household and personal care peers like Procter & Gamble, which typically command higher multiples. The new CEO and CFO have reset expectations following August earnings, with 2025 guidance lowered but deemed achievable. Organic sales are expected to improve, albeit remaining negative through 2025, signaling a turnaround phase rather than a decline.

This reset and the discounted valuation create a classic value-investing scenario: buy when others are fearful, especially when fundamentals and management changes suggest a path to recovery.

What This Means for Investors and Advisors

Here’s where Extreme Investor Network differs from the pack: We see this as more than just a buy-the-dip moment. It’s a strategic inflection point for investors to reassess their exposure to consumer health stocks amid evolving regulatory and litigation landscapes.

Actionable Insight #1: Investors should monitor upcoming scientific publications and regulatory announcements closely. While the FDA’s stance is currently supportive, new data could emerge. Maintaining a balanced position with risk controls is prudent.

Actionable Insight #2: Advisors should consider diversifying client portfolios within the consumer health sector, balancing established giants like Kenvue with smaller innovators who may benefit from shifting consumer preferences toward wellness and natural products.

Actionable Insight #3: Given the sector’s sensitivity to litigation risk, investors might explore options strategies to hedge downside while maintaining upside exposure—an approach rarely discussed but increasingly relevant.

What’s Next for Kenvue?

Looking forward, Kenvue’s trajectory will hinge on its ability to execute on the management’s reset guidance and navigate the regulatory environment without further reputational damage. The company’s premium valuation target (13x CY26e EV/EBITDA) reflects confidence in a rebound, but the path won’t be linear.

Interestingly, a recent survey by Morning Consult found that 68% of consumers remain loyal to established healthcare brands despite controversies, which bodes well for Kenvue’s entrenched portfolio. This consumer trust, combined with strategic leadership changes, could catalyze a turnaround.

Final Takeaway

For investors who can stomach some volatility, Kenvue’s current dip offers a rare entry point into a resilient sector with strong brand equity and long-term growth potential. The key is to stay informed, diversify wisely, and consider protective strategies against litigation risks.

As always, Extreme Investor Network will keep you ahead of the curve with the nuanced insights and actionable advice that matter most in today’s complex market landscape. Stay tuned for updates as this story unfolds.

Source: BofA sees ‘attractive entry point’ in Kenvue after Tylenol controversy