Bitcoin Endures Sharp Decline Amid Global Market Volatility

Bitcoin, the largest digital asset, faced significant pressure last week as global markets experienced a wave of risk aversion. This led to Bitcoin’s heftiest weekly loss since the collapse of the FTX exchange back in 2022. The original cryptocurrency tumbled by over 10% at one point before partially recovering to trade at $54,333 as of Monday morning in Singapore. The token ultimately recorded a 13.1% loss over the week, marking its steepest decline in several years.

This recent downturn in Bitcoin’s value is closely tied to the broader global stock selloff, reflecting concerns about the economic outlook. Additionally, uncertainty around the potential of artificial intelligence investments to deliver on their promises has exacerbated the situation. Rising geopolitical tensions in the Middle East have further heightened investor anxiety.

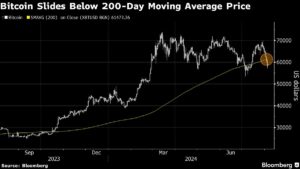

The pressure on Bitcoin is also evident in the outflows from Bitcoin exchange-traded funds in the US, which experienced their largest withdrawal in three months on August 2nd. Furthermore, the digital asset breached its 200-day moving average price, signaling a possible deeper pullback according to market analysts.

Since reaching a record high in March, Bitcoin has been impacted by various factors, including the unpredictable political landscape in the US. As the presidential race heats up between pro-crypto Republican Donald Trump and Democratic candidate Vice President Kamala Harris, uncertainty surrounding digital asset policies looms large.

Other challenges facing Bitcoin include the potential sale of seized Bitcoin by governments and the risk of an oversupply of tokens returned to creditors in bankruptcy proceedings. However, amidst the market turbulence, some analysts see a potential silver lining for cryptocurrencies. Bond traders are increasingly betting on US interest-rate cuts, which could support economic expansion and benefit the crypto market.

Although Bitcoin’s year-to-date growth has slowed to around 25%, compared to gold’s 18% rise and a 9% increase in global stocks, the long-term outlook remains uncertain. As investors navigate through this period of volatility, staying informed and staying diversified is crucial for financial success in the digital asset space.

Stay tuned to Extreme Investor Network for more insights and updates on the latest trends in the world of finance and investing.

© 2024 Extreme Investor Network. All rights reserved.