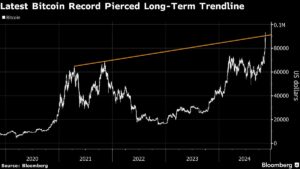

The cryptocurrency market is abuzz with excitement as Bitcoin surged above $93,000 amid anticipation of further interest rate cuts by the Federal Reserve and President-elect Donald Trump’s positive stance towards crypto assets. The digital asset experienced a nearly 6% increase in the US, reaching a record high of $93,462, before settling at $90,205 in London. Despite the fluctuation in the wider crypto market, Bitcoin’s momentum remained strong.

Speculators are closely monitoring Trump’s public support for digital assets to gauge whether Bitcoin will continue its upward trajectory towards $100,000 or if profit-taking will set in following a 34% surge since the US election. Chris Weston, head of research at Pepperstone Group, noted the possibility of opinion shifts resulting in increased two-way flows but emphasized the current uptrend in Bitcoin.

Market analysts attribute the recent rise in Bitcoin to the release of US inflation data that met analyst expectations, leading traders to increase bets on an imminent quarter-point rate cut by the Fed in December. However, Trump’s proposed tax cuts and trade tariffs policies add uncertainty by potentially fueling future price pressures.

Trump’s pledge to create a crypto-friendly regulatory environment, establish a strategic Bitcoin stockpile, and position the US as a global hub for the industry has caught the attention of industry players. Billionaire Michael Novogratz, the founder of Galaxy Digital LP, expressed skepticism about the feasibility of a US Bitcoin strategic reserve but predicted that Bitcoin could reach $500,000 if it comes to fruition.

The crypto rally has not only impacted the digital asset market but has also spilled over into the financial sector, driving peak trading volumes and inflows into US Bitcoin exchange-traded funds. Companies like MicroStrategy Inc., which have embraced Bitcoin on their balance sheets, are seeing significant growth in convertible US debt indicators.

As the excitement around Bitcoin continues to build, investors are keeping a close eye on the evolving regulatory landscape and market dynamics. Stay tuned to Extreme Investor Network for the latest updates and expert insights on navigating the world of finance and cryptocurrencies.